Why Are Alternatives to Payday Loans Important?

What Are Payday Loans?

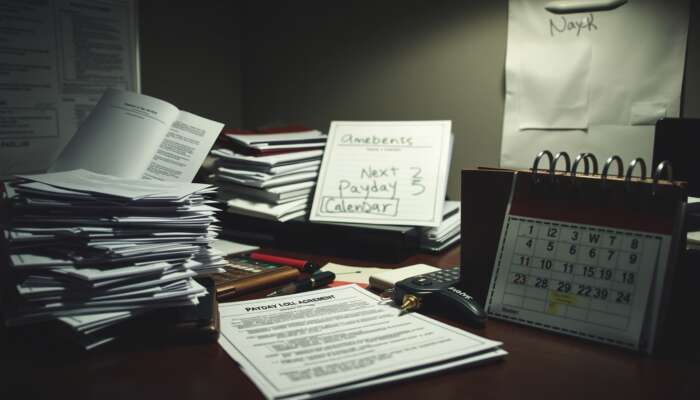

Payday loans are short-term financial products typically offered by non-bank lenders. These loans aim to cover urgent expenses until the borrower receives their next paycheck. They often come with high-interest rates and require full repayment on the borrower’s next payday, creating a precarious financial situation. While their easy access and minimal credit checks may seem appealing, payday loans can lead to severe financial distress if not managed correctly.

Many borrowers find themselves trapped in a cycle of debt due to high repayment amounts. Since payday loans usually require repayment within a few weeks, many individuals must take out additional loans to cover previous ones, leading to escalating financial burdens. Additionally, missed repayments can adversely affect credit scores. In Mississippi, where payday loans are prevalent, exploring alternatives can provide immediate relief and pave the way for a more sustainable financial future.

- High-interest rates

- Short repayment periods

- Minimal credit checks

- Potential for debt cycles

- Impact on credit scores

Why Should You Consider Alternatives?

Exploring alternatives to payday loans is crucial for achieving better financial health. Alternatives often provide lower interest rates, longer repayment terms, and more favorable conditions, significantly easing financial strain. By opting for manageable borrowing options, individuals can avoid falling into the debt trap that payday loans often create. This proactive approach can lead to reduced overall debt and less stress associated with financial obligations.

Furthermore, considering alternatives encourages individuals to develop healthier financial habits. For instance, by utilizing personal loans or payment plans, borrowers can learn to budget their expenses more effectively, leading to improved financial literacy. Understanding one’s financial options fosters a sense of empowerment and control, encouraging informed decisions that align with long-term financial goals.

- Lower interest rates

- Longer repayment terms

- Improved financial literacy

- Less financial stress

- Empowerment through informed decisions

What Are the Risks of Payday Loans?

The risks associated with payday loans are significant and multifaceted. One pressing concern is the potential for a cycle of debt. Borrowers often find themselves unable to repay the entire amount on the due date, leading them to roll over their loans or take out additional ones. This cycle can spiral, resulting in crippling debt that is difficult to escape. Moreover, payday loans typically come with exorbitant interest rates, which can compound rapidly if payments are missed or delayed.

Beyond financial repercussions, payday loans can also impact borrowers emotionally and psychologically. The stress of managing multiple loans and constant financial worry can lead to anxiety and other mental health issues. It is crucial for individuals to assess these risks carefully before considering payday loans and to explore the multitude of available alternatives that can offer relief without the same level of danger.

- Potential for debt cycles

- High-interest rates

- Emotional stress

- Impact on mental health

- Difficulty escaping debt

What Are the Best Alternatives to Payday Loans in Mississippi?

What Are Some Common Alternatives?

When seeking alternatives to payday loans, several viable options can provide relief without the associated risks. Common alternatives include credit unions, personal loans, and payment plans. Each of these options has unique advantages and disadvantages, making it essential for potential borrowers to assess their financial situations thoroughly before making a decision. Exploring various Credit Solutions can lead to better financial outcomes and reduce reliance on payday loans. For residents in Jackson, MS, exploring these alternatives can lead to better financial outcomes. Consider exploring options like Build Credit in Mississippi with Affordable Loans to enhance your financial stability. One option to consider is Credit Builder Loans for Families in Mississippi, which can help improve your financial situation. For those struggling with repayment, exploring Payday Loan Debt Management Strategies for Fixed Incomes can be beneficial.

Credit unions often offer lower interest rates and more flexible repayment terms than traditional lending institutions, making them an excellent choice for individuals in need of short-term financial assistance. Personal loans, particularly those from reputable lenders, typically have more favorable terms than payday loans, including lower interest rates and longer repayment durations. On the other hand, payment plans can help borrowers manage their debts without taking on new loans, allowing them to pay off existing bills in installments that fit their budgets.

| Alternative | Interest Rates | Repayment Terms | Flexibility |

|---|---|---|---|

| Credit Unions | Lower | Flexible | High |

| Personal Loans | Moderate | Longer | Moderate |

| Payment Plans | Varies | Customizable | High |

- Access to lower interest rates

- Longer repayment periods

- Flexible terms based on individual circumstances

- Potential for improving credit scores with timely payments

- Community-focused services through credit unions

- Less pressure to repay in a short timeframe

How Can Credit Unions Help?

Credit unions serve as a more favorable alternative to payday loans, particularly in Mississippi. These member-owned financial institutions typically provide lower interest rates and more personalized service compared to traditional banks or payday lenders. Credit unions prioritize their members’ financial health and often offer flexible loan terms that can be tailored to individual circumstances.

Many credit unions also provide financial education resources, helping their members understand their borrowing options and manage their finances effectively. This emphasis on community and support fosters a trusting environment where borrowers feel empowered to make informed decisions. Additionally, by becoming a member of a credit union, individuals often gain access to a range of financial products, including savings accounts and investment services, which can further enhance their financial stability.

- Lower interest rates

- Personalized service

- Financial education resources

- Access to diverse financial products

- Community-focused environment

What Steps Should You Take to Access Alternatives?

Accessing alternatives to payday loans involves a systematic approach that can yield favorable results. First, begin by conducting thorough research on local credit unions. Many of these institutions are not-for-profit, which means they can offer better rates and terms. Look for credit unions in your area, such as those affiliated with local employers or community organizations.

Next, compare interest rates among various lending options. Websites that aggregate loan offers can provide a clear picture of what’s available in terms of rates and terms. Assess the eligibility requirements for each option; some may have specific membership criteria or income stipulations that you need to consider. Lastly, gather necessary documentation, such as proof of income and identification, to streamline the application process once you’ve identified a suitable alternative.

- Research local credit unions

- Compare interest rates

- Assess eligibility requirements

- Gather required documentation

What Are the Benefits of Using Alternatives?

How Do Personal Loans Compare to Payday Loans?

Personal loans present a compelling alternative to payday loans, primarily due to their lower interest rates and extended repayment terms. Unlike payday loans, which often require full repayment within a matter of weeks, personal loans can offer repayment periods ranging from a few months to several years, allowing borrowers to manage payments more comfortably.

This flexibility significantly reduces financial stress and enables borrowers to budget effectively. Additionally, personal loans can improve credit scores when payments are made on time, further enhancing financial opportunities in the future. For those considering taking out a loan, personal loans represent a responsible and potentially less risky option compared to the impulsive nature of payday borrowing.

| Loan Type | Interest Rates | Repayment Period | Impact on Credit Score |

|---|---|---|---|

| Payday Loans | High | Weeks | Negative |

| Personal Loans | Lower | Months to Years | Positive |

- Lower interest rates

- Extended repayment terms

- Improved credit score potential

- Less financial stress

What Are the Benefits of Payment Plans?

Payment plans are another effective alternative to payday loans, allowing borrowers to pay their debts in manageable installments. This approach reduces the financial strain typically associated with lump-sum repayments required by payday loans. By breaking down payments into smaller, more manageable amounts, borrowers can maintain their financial obligations without overwhelming stress.

Furthermore, payment plans can help individuals avoid incurring additional debt, as they can focus on paying off existing obligations rather than seeking new forms of credit. This method not only promotes responsible borrowing but also encourages better financial planning and budgeting habits, essential for long-term financial health.

- Improved cash flow management

- Reduced risk of falling into debt

- Encouragement of responsible financial behavior

- Less stress associated with payment deadlines

What Key Benefits Should You Consider for Alternatives?

When considering alternatives to payday loans, several key benefits stand out, enhancing the appeal of these options. First, alternatives typically offer lower interest rates, significantly decreasing the overall cost of borrowing. Additionally, they provide flexible repayment terms that can adapt to a borrower’s financial situation, making payments more manageable. Improved access to legitimate financial services and support is another notable advantage.

Moreover, many alternatives promote financial education, helping individuals develop sound budgeting skills and enhance their overall financial literacy. Ultimately, these benefits lead to greater financial stability, allowing individuals to achieve their long-term goals without the debilitating pressure that often accompanies payday loans.

- Lower interest rates

- Flexible repayment terms

- Access to financial education resources

- Improved cash flow management

- Supportive community-focused services

Why Are Credit Unions a Viable Option?

Credit unions present a viable alternative to payday loans for several reasons. Firstly, they often provide lower interest rates and fees compared to traditional banks and payday lenders. This affordability makes them accessible for individuals seeking short-term financial assistance without incurring crippling debt. Secondly, credit unions are member-owned, which means they prioritize the financial well-being of their members over profit, fostering a supportive environment.

Additionally, credit unions typically offer personalized service and financial counseling, helping members navigate their financial options effectively. This member-focused approach encourages responsible borrowing and financial literacy, allowing individuals to make informed decisions about their finances. For those in Mississippi seeking alternatives to payday loans, credit unions are an excellent resource worth considering.

- Lower interest rates

- Member-focused service

- Financial counseling

- Supportive community

How Do Peer-to-Peer Lending Platforms Work?

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders, creating a marketplace for loans outside traditional banking systems. This innovative approach often results in lower rates and more flexible terms compared to conventional lending institutions. Borrowers can present their financial needs on these platforms, and lenders can choose to fund the loan based on their individual criteria.

The decentralized nature of P2P lending allows for competitive rates, as lenders can set their interest rates based on the perceived risk of the borrower. Additionally, P2P platforms typically offer quicker access to funds, making them a practical alternative for urgent financial needs. However, borrowers should be ready to present a solid repayment plan and be mindful of potential fees that might accompany these loans.

- Lower interest rates

- Flexible repayment terms

- Improved credit score potential

- Faster access to funds

What Trusted Strategies Can Help You Find Alternatives to Payday Loans in Mississippi?

How to Improve Your Credit Score?

Improving your credit score is an essential step in accessing better loan options, including alternatives to payday loans. A higher credit score can open doors to lower interest rates and more favorable terms, allowing individuals to borrow responsibly. To begin improving your credit score, it’s important to check your credit report for errors and dispute any inaccuracies promptly.

Timely payments on existing debts are another crucial factor; consistently paying bills on time can enhance your creditworthiness. Reducing credit card balances and keeping them low relative to your credit limits can further improve your score. By implementing these strategies, individuals can enhance their financial standing, making it easier to qualify for alternatives to payday loans.

- Check credit report for errors

- Make timely payments

- Reduce credit card balances

- Maintain low credit utilization

What Expert Analysis Can Help with Financial Planning?

Financial planning plays a pivotal role in avoiding reliance on payday loans. Comprehensive financial planning involves creating a budget that outlines income, expenses, and savings goals. Experts recommend tracking spending habits to identify areas where individuals can cut back and save more effectively. By establishing an emergency fund, individuals can prepare for unexpected expenses without resorting to high-interest borrowing options.

Moreover, setting realistic financial goals and creating a repayment plan for existing debts can help individuals regain control over their finances. Seeking advice from financial planners or utilizing online tools to enhance budgeting skills can provide further support in developing a robust financial plan, ultimately reducing the reliance on payday loans.

- Create a budget

- Track spending habits

- Establish an emergency fund

- Set realistic financial goals

What Resources Are Available for Financial Education?

Numerous resources are available for individuals seeking to improve their financial literacy, essential for making informed decisions regarding loan alternatives. Online courses, webinars, and workshops offered by community organizations or financial institutions can provide valuable insights into effective budgeting, saving, and investing strategies. These educational opportunities often focus on practical skills that empower individuals to take charge of their financial futures.

Additionally, many credit unions and non-profit organizations offer free financial counseling services, where individuals can receive tailored advice based on their unique financial situations. This personalized guidance can help borrowers navigate their options and make more informed decisions about their financial health. By taking advantage of these resources, individuals can build a solid foundation for a stable financial future.

- Online courses

- Webinars and workshops

- Free financial counseling

- Tailored financial advice

How to Explore Credit Union Alternatives?

Exploring alternatives through credit unions can offer substantial benefits, particularly for those in need of short-term financial assistance. Credit unions typically provide more favorable terms and rates compared to payday lenders, making them an excellent option for individuals looking for alternatives. Many credit unions have flexible lending options tailored to meet the unique needs of their members, including personal loans with lower interest rates and longer repayment terms.

Moreover, credit unions often emphasize education, providing resources that help members improve their financial literacy. These institutions prioritize the financial health of their members, fostering a community-focused environment where borrowers can feel supported throughout their financial journeys. By considering credit unions as an alternative to payday loans, individuals can gain access to more sustainable financial solutions.

- Flexible lending options

- Lower interest rates

- Community-focused environment

- Financial literacy resources

What Are the Advantages of Peer-to-Peer Lending?

Peer-to-peer lending offers several notable advantages that make it an attractive alternative to payday loans. Firstly, these platforms typically provide competitive interest rates, often lower than those associated with traditional lending options. As borrowers and lenders directly engage, the competition can drive rates down, allowing individuals to secure better financing terms.

Additionally, P2P lending platforms generally expedite the loan process, enabling borrowers to access funds more quickly than they would through conventional banks. This rapid access can be particularly beneficial for those facing urgent financial needs. Furthermore, the flexibility in repayment arrangements allows borrowers to negotiate terms that work for their individual circumstances, promoting responsible borrowing and financial management.

- Competitive interest rates

- Faster access to funds

- Flexible repayment arrangements

- Direct engagement with lenders

What Are the Risks of Peer-to-Peer Lending?

While peer-to-peer lending presents numerous advantages, it also carries certain risks that potential borrowers should consider. One significant concern is the possibility of higher fees associated with some P2P platforms, which could offset the benefits of lower interest rates. Additionally, interest rates on P2P loans can be variable, meaning they may fluctuate over time based on market conditions.

Moreover, borrowers should be aware of the potential for a lack of regulation in the P2P lending space. Unlike traditional banks, which are subject to stringent oversight, P2P lending platforms may not always provide the same consumer protections, potentially leaving borrowers vulnerable. It is essential to conduct thorough research and understand the terms and risks before engaging in peer-to-peer lending.

- Potential for higher fees

- Variable interest rates

- Lack of regulation

- Need for thorough research

What Should You Look for in a Loan Alternative?

How Important Is the Interest Rate?

The interest rate is a critical factor in determining the overall cost of borrowing, making it one of the most important aspects to consider when seeking a loan alternative. A lower interest rate can significantly reduce the total amount paid over the life of the loan, making it essential to compare rates among various lenders. This comparison helps borrowers identify the most affordable options and avoid high-interest loans that could lead to financial distress.

Furthermore, understanding how interest is calculated—whether it is fixed or variable—can impact long-term affordability. Fixed rates provide predictability in monthly payments, while variable rates may fluctuate, affecting overall repayment costs. By prioritizing interest rates in their decision-making process, borrowers can choose alternatives that align with their financial goals and capabilities.

- Compare interest rates

- Understand fixed vs. variable rates

- Prioritize affordability

- Align loans with financial goals

What Should You Know About Terms and Conditions?

Understanding the terms and conditions of any loan is crucial to avoid hidden fees and unfavorable agreements. Borrowers should carefully read all documentation associated with the loan, seeking clarity on aspects such as repayment schedules, fees, and penalties for late payments. This diligence helps to ensure there are no surprises after the loan is secured.

By being informed about the terms, borrowers can make better decisions and avoid potential pitfalls that could lead to financial distress. Always ask questions if any part of the agreement is unclear, ensuring a full understanding before committing to a loan.

- Read all documentation carefully

- Seek clarity on repayment schedules

- Understand fees and penalties

- Avoid surprises after securing a loan

See also: Finance & Business.

See also: Starkville, MS.

A Mississippi-based financial consultant with over a decade of experience in personal finance and payday lending. Originally from Jackson, he holds certifications in financial planning and credit advisory. Passionate about helping everyday Americans make smarter borrowing decisions, he focuses on guiding people away from common debt traps while promoting healthy financial habits. His expertise bridges the gap between short-term loan needs and long-term money management strategies. Outside of work, he volunteers with local programs that promote financial literacy across Mississippi.

It’s fascinating how prevalent payday loans have become, especially in places like Mississippi. I’ve seen firsthand how easy it is for someone to get caught in that cycle. My friend once took out a payday loan to cover a car repair, thinking it was a quick fix, but that spiraled into multiple loans within a few months. It really highlights the importance of having viable alternatives.