Comprehensive Guide to Payday Loan Regulations in Mississippi

Differences Between Federal and State Regulations on Payday Lending

Navigating the financial realm of payday loans involves understanding a myriad of federal and state regulations that govern their use. At the federal level, laws such as the Truth in Lending Act set fundamental protections for consumers across the nation. However, individual states, including Mississippi, have the autonomy to implement stricter regulations that reflect the specific economic conditions and demographic needs of their residents. In Mississippi, the unique economic demographics often leave many individuals susceptible to high-interest lending practices, highlighting the importance of understanding both federal and state laws. By familiarizing themselves with these regulations, borrowers can better safeguard their rights and make informed choices that positively impact their financial wellbeing.

The regulatory framework around payday loans in Mississippi emphasizes the protection of consumers, featuring provisions that limit interest rates and establish clear loan terms. It is crucial for borrowers to distinguish these state regulations from federal laws, which may not provide equivalent levels of protection. By grasping how these laws interact, borrowers can actively assert their rights, circumvent potential debt traps, and ultimately foster a more secure financial future.

Essential Regulatory Provisions Governing Payday Loans in Mississippi

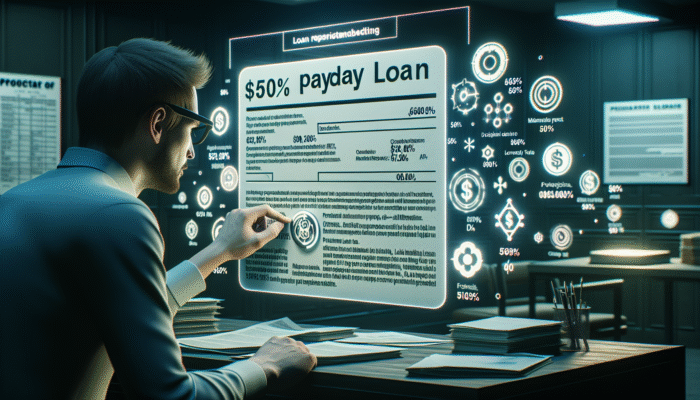

In Mississippi, the regulations surrounding payday loans include several vital provisions aimed at protecting borrowers from exploitation. One of the most critical elements is the establishment of a cap on interest rates, which serves to prevent lenders from imposing exorbitant fees that could lead to a debilitating cycle of debt. For instance, payday lenders in Mississippi are restricted to a maximum annual percentage rate (APR) of 569%. Although this figure may seem steep in comparison to traditional bank loans, it is a significant improvement over the rates charged by many unregulated lenders, ensuring a degree of financial safety for borrowers seeking immediate relief.

Additionally, Mississippi law mandates specific loan terms, guaranteeing borrowers sufficient time to repay their loans without undue stress. For example, the law requires a minimum loan term of 14 days for payday loans. This regulation is designed to afford borrowers a reasonable opportunity to meet their financial responsibilities and to avert the dangers of rollover loans, which can exacerbate debt issues. Regulatory bodies overseeing these provisions play an essential role in monitoring compliance among lenders, thereby reinforcing consumer protection in the lending landscape.

The Significant Effects of Payday Loan Regulations on Borrowers

The regulatory framework governing payday loans in Mississippi has profound implications for borrowers, particularly for those who may lack financial literacy. By implementing caps on interest rates and defining clear repayment terms, these regulations aim to shield borrowers from falling into perilous debt traps that can lead to dire financial consequences. Nevertheless, it remains imperative for borrowers to stay informed and vigilant about their rights and responsibilities as outlined by these regulations.

A thorough understanding of these provisions empowers borrowers to make informed financial choices and to recognize predatory lending practices. For example, if a borrower encounters an offer with an interest rate that exceeds the legal ceiling, they are entitled to report the lender to the relevant regulatory authorities. Moreover, borrowers should proactively seek information on available financial literacy programs in Mississippi, which can offer crucial tools for effective debt management.

Despite the protective measures in place, borrowers must acknowledge their accountability for their financial decisions. Grasping the full scope of the regulations, including fees and repayment terms, is essential for successfully navigating the payday loan landscape. Borrowers should also remain cautious of lenders who may engage in aggressive tactics to collect debts, as these strategies can lead to increased financial strain and hardship.

Understanding effective debt management strategies is crucial for borrowers to avoid pitfalls associated with payday loans.

The Role of Regulatory Bodies in Enforcing Payday Loan Laws

In Mississippi, the enforcement of payday loan regulations is managed by various regulatory bodies, including the Mississippi Department of Banking and Consumer Finance. These organizations are instrumental in ensuring compliance with state laws and in protecting consumers from unethical lending practices. They routinely conduct audits and investigations to assess lenders’ adherence to the established regulations.

When lenders breach these regulations, they face severe penalties, which may include hefty fines and potential legal repercussions. Such enforcement actions not only discourage unethical behavior but also cultivate a healthier lending environment for consumers. Borrowers are encouraged to report any violations they encounter, as these actions contribute significantly to maintaining integrity within the payday loan market.

Furthermore, staying informed about the enforcement mechanisms in place empowers borrowers to navigate disputes with lenders effectively. Should a borrower suspect they have been charged an illegal interest rate, they can file a complaint with the regulatory agency overseeing payday lending. This process underscores the importance of being aware of one’s rights and the resources available for recourse in the event of a dispute.

Keeping Up with Changes in Payday Loan Regulations

The regulatory landscape surrounding payday loans is dynamic, necessitating that borrowers in Mississippi remain vigilant regarding any updates to the laws that govern payday lending practices. Regulatory bodies consistently review existing legislation to adapt to shifting economic conditions and the evolving needs of consumers. Such changes can have a significant impact on borrowers’ rights and the terms under which they can obtain payday loans.

For instance, if new legislation is introduced that lowers interest rate caps or expands repayment terms, it could create more favorable conditions for borrowers. Conversely, any relaxation of regulations could introduce risks, potentially resulting in higher rates and shorter repayment periods. Consequently, it is vital for borrowers to stay informed about these developments to protect themselves against predatory lending practices.

To remain updated, borrowers should routinely visit the Mississippi Department of Banking and Consumer Finance website and consider subscribing to newsletters or alerts from consumer advocacy organizations. These resources can provide timely information about regulatory changes and offer advice on responsibly managing payday loan debt.

Understanding Payday Loan Debt Limits in Mississippi

Maximum Loan Amounts for Responsible Borrowing

In Mississippi, the maximum allowable loan amount for payday loans is strategically established to protect borrowers from falling into unmanageable debt. The law stipulates that payday loans cannot exceed $500 at any single time. This limit is designed to ensure that borrowers do not overextend their financial capabilities, which could lead to a debilitating cycle of debt that is difficult to escape.

By imposing this maximum loan amount, Mississippi aims to encourage responsible lending practices and to shield borrowers from becoming trapped in high-interest debt scenarios. For instance, a borrower who secures a $500 payday loan at an interest rate of 569% APR would face a substantial repayment obligation in a short timeframe. This structure encourages borrowers to carefully consider their financial circumstances and the implications of taking on payday loans before making a commitment.

It is essential for borrowers to recognize that while the maximum loan amount is set, it does not eliminate the inherent risks associated with payday lending. Borrowers must evaluate their ability to repay the loan within the designated timeframe and explore other options before resorting to payday loans. Additionally, understanding how this cap interacts with various lending products can empower borrowers to make more informed decisions when seeking financial assistance.

Protective Interest Rate Caps on Payday Loans

Interest rates on payday loans in Mississippi are regulated to limit the cost of borrowing, serving as a vital safeguard for consumers. The maximum allowable APR for payday loans is set at 569%, which, while still considerably high compared to traditional lending options, is lower than the rates imposed by many unregulated lenders. This interest rate cap plays a crucial role in preventing lenders from taking advantage of vulnerable borrowers who may have limited access to credit.

Comprehending how interest rate caps function is critical for borrowers. For example, if a borrower secures a $300 payday loan for 14 days, they will incur significant fees; however, those fees are strictly regulated. The cap ensures that lenders cannot impose exorbitant charges beyond the legal limit, offering a degree of financial protection for consumers. This regulation encourages borrowers to carefully weigh the costs associated with payday loans against other potential financial options, thereby fostering greater financial awareness.

While the interest cap appears protective, it is imperative for borrowers to understand the implications of borrowing at such high rates. The cumulative effects of fees can be overwhelming, particularly if borrowers struggle to repay the loan on time. It is advisable for borrowers to explore alternative lending options, such as credit unions, which may provide lower interest rates and more favorable terms.

Defined Repayment Terms for Payday Loans

Repayment terms for payday loans in Mississippi are meticulously regulated to ensure that borrowers are afforded a reasonable timeframe to settle their debts. According to Mississippi law, payday loans are mandated to have a minimum term of 14 days, a provision that is crucial in preventing the cycle of debt that frequently ensnares borrowers in financial challenges.

This minimum repayment period is crafted to provide borrowers with sufficient time to organize their finances and manage loan repayments without undue pressure. For instance, a borrower who takes out a payday loan to address unexpected expenses can plan their budget around the 14-day repayment cycle instead of facing immediate repayment demands.

However, while the minimum repayment term offers some breathing room, borrowers should remain alert to the risks associated with rollover loans. If a borrower is unable to repay the loan within the 14-day period, they may be tempted to secure a new loan to cover the previous one, resulting in a vicious cycle of debt. Understanding the ramifications of rollover loans, including added fees and heightened debt levels, is essential for borrowers seeking to manage their finances responsibly.

It is crucial for borrowers to devise a comprehensive repayment strategy prior to undertaking a payday loan. This plan should encompass an evaluation of their current financial situation and a realistic budget that includes loan repayment. By approaching payday loans with a well-structured strategy, borrowers can mitigate their risk of falling into a debt trap.

The Consequences of Exceeding Debt Limits

Legal Consequences for Lenders and Borrowers

Surpassing the debt limits established for payday loans in Mississippi can result in serious legal consequences for both lenders and borrowers. When lenders breach state regulations by issuing loans that exceed the legal thresholds, they expose themselves to substantial penalties, including fines and potential legal action. This rigorous enforcement is aimed at safeguarding vulnerable borrowers from predatory lending practices that can lead to significant financial distress.

For borrowers, the repercussions of exceeding debt limits can be equally severe. If a borrower takes on multiple payday loans that collectively exceed the state’s legal limit, they may find themselves in a precarious financial situation. This can provoke legal actions from lenders, including lawsuits to recover outstanding debts, further exacerbating the borrower’s financial troubles. By understanding these legal ramifications, borrowers can make informed choices and avoid engaging in practices that could lead to excessive debt.

Additionally, borrowers should be cognizant of their rights under Mississippi law. If they believe they have fallen victim to illegal lending practices, they should report the lender to the appropriate regulatory bodies. This process fosters accountability among lenders and helps maintain a fair lending environment for all consumers.

Financial Penalties Associated with Exceeding Debt Limits

Exceeding the debt limits for payday loans can also result in significant financial penalties for borrowers, compounding their financial struggles. If a borrower incurs more debt than permitted, they may face additional fees or interest charges, which can accumulate rapidly. This situation can create a vicious cycle where the borrower finds it increasingly challenging to keep up with repayments, leading to late fees and heightened financial stress.

Understanding the specific financial penalties related to exceeding debt limits is essential for borrowers in Mississippi. For example, certain lenders may impose hefty late fees or additional interest charges if a borrower fails to repay their loan within the stipulated timeframe. These costs can escalate quickly, pushing borrowers deeper into debt and making recovery increasingly arduous.

Moreover, borrowers must recognize that financial penalties can create a negative feedback loop, where increased debt leads to more penalties, further escalating debt. To avoid these pitfalls, borrowers should develop a clear repayment strategy and consider alternative options for managing their finances before resorting to payday loans.

The Adverse Effects of Exceeding Debt Limits on Credit Scores

Violating debt limits can have a detrimental impact on a borrower’s credit score in Mississippi, a critical factor influencing their long-term financial health. Credit scores are utilized by lenders to gauge the creditworthiness of borrowers, and exceeding debt limits can indicate financial irresponsibility to potential lenders.

When a borrower accumulates excessive payday loans, it may lead to missed payments, defaults, or collection actions, all of which contribute to a diminished credit score. A lower credit score can hinder future borrowing opportunities, making it more difficult for individuals to secure credit cards, personal loans, or mortgages. In a state where access to affordable credit is already constrained, this impact can be particularly damaging.

Borrowers should adopt proactive measures to manage their credit by regularly monitoring their credit reports and understanding how payday loans affect their overall financial standing. By making timely repayments and avoiding exceeding debt limits, borrowers can protect their credit scores and maintain access to financial opportunities in the future.

Future Borrowing Restrictions Due to Debt Limit Violations

Exceeding debt limits can lead to restrictions on acquiring future loans in Mississippi, impacting borrowers’ access to credit when they need it most. Lenders evaluate a borrower’s financial history and creditworthiness when processing loan applications, and a history of exceeding debt limits can raise significant concerns.

For instance, if a lender identifies that an applicant has previously taken out loans exceeding the legal maximum, they may interpret this as a sign of financial instability. This perception can result in higher interest rates or the outright denial of future credit applications. Therefore, it is crucial for borrowers to comply with state regulations and avoid exceeding debt limits to preserve their borrowing options.

Furthermore, borrowers who find themselves in circumstances where they have exceeded the debt limit should explore strategies to enhance their creditworthiness. This may involve paying down existing debts, establishing a consistent payment history, and engaging in responsible financial practices. By taking these initiatives, borrowers can rebuild their credit and improve their access to future borrowing opportunities.

Exploring Alternatives to Payday Loans in Mississippi

Accessing Credit Union Loans for Financial Relief

Credit unions present an appealing alternative to payday loans in Mississippi, offering members more favorable lending conditions. Unlike payday lenders, credit unions operate as non-profit organizations that prioritize the financial well-being of their members. This structure enables credit unions to provide lower interest rates and more flexible repayment terms, making them an attractive choice for individuals seeking financial assistance.

For instance, numerous credit unions in Mississippi offer small personal loans with interest rates that are significantly lower than the exorbitant 569% APR commonly associated with payday loans. Additionally, credit unions often emphasize personalized service, with loan officers willing to collaborate with borrowers to develop solutions tailored to their financial situations. This level of support can be invaluable for individuals grappling with financial difficulties.

Moreover, while credit unions typically require membership, which may involve a nominal fee or initial deposit, the long-term savings associated with lower interest rates and improved lending practices can outweigh these initial costs. By opting for credit union loans, borrowers gain access to more affordable credit while supporting a local financial institution that invests in the community.

Personal Loans from Traditional Banks as an Alternative

Personal loans from traditional banks represent another viable alternative to payday loans for residents of Mississippi. Conventional banks often offer personal loans with reasonable interest rates and structured repayment terms, making them more manageable compared to payday loans. For borrowers with established credit histories, banks can provide access to larger loan amounts that can be repaid over an extended period.

For residents in Meridian, MS, exploring personal loans can be a beneficial alternative to payday loans.

The appeal of bank loans lies in their transparency and predictability. Unlike payday loans, which can come with hidden costs and aggressive repayment schedules, bank loans typically feature straightforward terms that borrowers can easily comprehend. For example, a bank may offer a fixed interest rate and a defined repayment period, allowing borrowers to plan their budgets with clarity.

However, it is crucial for borrowers to recognize that securing a bank loan may necessitate a credit check and could require some form of collateral, depending on the loan amount and the borrower’s creditworthiness. Those with poor credit may find it challenging to obtain a bank loan, but it is still worth exploring options, especially if they can enhance their credit score over time.

Non-Profit Financial Assistance Programs for Support

Non-profit organizations in Mississippi provide invaluable resources for individuals seeking financial assistance without incurring the high costs associated with payday loans. These organizations frequently offer financial counseling, educational programs, and even direct assistance for those facing financial hardships.

For example, many non-profits conduct workshops focused on budgeting, debt management, and financial literacy. By participating in these programs, borrowers can acquire essential skills that enable them to manage their finances more effectively and avoid falling into the payday loan trap in the future. Additionally, some organizations provide emergency financial assistance for individuals in crisis, offering crucial support without the burdensome interest rates of payday loans.

Furthermore, non-profit organizations often collaborate with local governments and community programs to enhance their service offerings. By connecting borrowers with available resources, these organizations can assist individuals in navigating their financial challenges and developing sustainable strategies for long-term financial success.

Effective Strategies for Managing Payday Loan Debt

Implementing Budgeting Techniques for Debt Management

Establishing effective budgeting techniques is a foundational strategy for managing and repaying payday loan debt in Mississippi. By creating a detailed budget, borrowers can identify their income sources, track their expenses, and allocate funds specifically for debt repayment. This proactive approach empowers borrowers to take control of their finances and helps to prevent the cycle of debt that often accompanies payday lending.

To begin, individuals should outline their monthly income and categorize their expenses into fixed and variable costs. This assessment allows borrowers to identify areas where they can reduce discretionary spending and redirect those funds toward paying off their payday loans. For instance, cutting back on dining out or entertainment expenses can free up essential cash for debt repayment.

Additionally, borrowers should prioritize timely loan repayments to avoid penalties and additional fees. Setting up automatic payments or reminders can help ensure that payments are consistently made on time. By adopting these budgeting strategies, borrowers can formulate a sustainable plan to manage their payday loan debt effectively.

Exploring Debt Consolidation Options for Relief

Debt consolidation offers a practical solution for Mississippi borrowers struggling under the weight of payday loan debt. By consolidating multiple payday loans into a single loan, borrowers can simplify their repayment process and potentially lower their overall interest rates. This strategy can make managing monthly payments more feasible, alleviating some of the stress commonly associated with juggling multiple loans.

Various consolidation options exist, including personal loans from banks or credit unions, balance transfer credit cards, and specialized debt consolidation loans. The key is to select a consolidation option that provides a lower interest rate than the existing payday loans, allowing for significant savings over time.

Moreover, borrowers should carefully review the terms and fees associated with consolidation loans to ensure they are making a sound financial decision. While consolidation can offer relief, it’s crucial to approach it with a thorough understanding of the long-term implications and to maintain disciplined repayment habits.

Seeking Guidance from Financial Professionals

For borrowers finding it challenging to navigate payday loan debt, seeking professional advice from financial advisors in Mississippi can be transformative. These professionals provide tailored guidance on debt management, budgeting, and financial planning. They can assist borrowers in evaluating their financial situations, developing realistic repayment strategies, and exploring options for reducing or eliminating debt.

Financial advisors often have insight into available resources, such as non-profit organizations that offer financial assistance or counseling. They can also guide borrowers through complex financial regulations and empower them to make informed decisions regarding their financial futures.

Engaging with a financial advisor can also help borrowers regain control over their finances and chart a course toward long-term financial stability. By tackling the underlying issues contributing to their financial challenges, borrowers can develop sustainable strategies for effectively managing their debt.

Essential Resources for Payday Loan Borrowers in Mississippi

Utilizing State Government Websites for Information

State government websites serve as invaluable resources for Mississippi borrowers seeking insights on payday loan regulations and consumer protections. The Mississippi Department of Banking and Consumer Finance offers comprehensive information on the state’s payday loan laws, including interest rate caps, loan limits, and borrower rights.

By accessing these official websites, borrowers can obtain current information about regulatory changes and available resources. Furthermore, government websites often feature guides and FAQs addressing common concerns related to payday loans. This transparency empowers borrowers to make informed decisions and to fully understand their rights within the lending framework.

Additionally, engaging with state government resources can help borrowers remain aware of any modifications to payday loan laws, ensuring they are informed about their rights and responsibilities. Regularly checking these websites can enhance borrowers’ comprehension of the payday loan landscape and equip them with the necessary knowledge to navigate it successfully.

Participating in Financial Literacy Programs

Financial literacy programs in Mississippi play a pivotal role in educating borrowers about managing payday loans and fostering overall financial health. These programs often cover essential topics such as budgeting, saving, credit management, and responsible borrowing. By participating, borrowers can gain valuable skills that empower them to make sound financial decisions.

Local non-profits, community colleges, and even some banks provide financial literacy workshops that offer hands-on training and resources. These programs can be particularly beneficial for individuals lacking access to financial education in the past. By enhancing their financial literacy, borrowers can develop strategies for effectively managing their payday loan debt and avoiding similar pitfalls in the future.

Moreover, engaging in financial literacy initiatives fosters a sense of community and support among participants. Borrowers can share experiences, learn from one another, and build a network of support as they strive toward financial stability.

Accessing Legal Aid Services for Assistance

Legal aid services in Mississippi can be a critical resource for borrowers encountering issues related to payday loans. These organizations provide free or low-cost legal assistance to individuals facing financial challenges, including those stemming from debt and lending practices. Legal aid can help borrowers understand their rights, navigate disputes with lenders, and explore potential options for resolving their financial issues.

For example, if a borrower suspects they have been subjected to illegal lending practices, legal aid services can offer direction on how to file complaints with regulatory authorities. Additionally, they can provide representation in legal matters, aiding borrowers in negotiating settlements or contesting unfair lending practices.

Utilizing legal aid services empowers borrowers to take control of their financial situations and seek justice when required. By understanding their rights and leveraging legal resources, borrowers can navigate the complexities of payday loans with increased confidence.

Connecting with Nonprofit Organizations for Support

Nonprofit organizations in Mississippi are dedicated to assisting borrowers facing financial difficulties, providing essential resources and guidance. Many of these organizations offer a variety of services, from financial counseling and education to direct assistance for individuals in crisis.

By connecting with nonprofit organizations, borrowers gain access to valuable resources that can help them navigate the payday loan landscape. These organizations often collaborate with local governments and community partners to enhance their service offerings, ensuring that individuals receive the necessary support to manage their financial situations effectively.

Additionally, nonprofit organizations frequently host community workshops and events focused on improving financial literacy and raising awareness about responsible borrowing practices. By participating in these initiatives, borrowers can acquire critical knowledge that equips them to make informed decisions and avoid the pitfalls of payday lending in the future.

Frequently Asked Questions About Payday Loans in Mississippi

What is the maximum payday loan amount allowed in Mississippi?

The maximum payday loan amount in Mississippi is capped at $500, a measure implemented to prevent borrowers from incurring excessive debt.

What are the interest rate limits for payday loans in Mississippi?

Interest rates for payday loans in Mississippi are capped at 569% APR, which is significantly lower than the rates charged by many unregulated lenders.

How much time do I have to repay a payday loan in Mississippi?

Payday loans in Mississippi must include a minimum repayment term of 14 days, providing borrowers with adequate time to manage their financial obligations.

What are the consequences of exceeding payday loan debt limits?

Exceeding payday loan debt limits can result in legal consequences for lenders and financial penalties for borrowers, along with adverse effects on credit scores.

Are there alternatives to payday loans available in Mississippi?

Yes, alternatives include loans from credit unions, personal loans from banks, and assistance from nonprofit organizations offering financial counseling.

What strategies can I employ to effectively manage payday loan debt?

Effective management strategies include budgeting, considering debt consolidation options, and seeking professional assistance from financial advisors.

What resources are accessible for payday loan borrowers in Mississippi?

Resources include state government websites, financial literacy programs, legal aid services, and nonprofit organizations offering support and guidance.

Can legal aid services assist with payday loan-related issues?

Yes, legal aid services can help borrowers understand their rights, navigate disputes with lenders, and explore options for resolving financial challenges.

How can I improve my credit score after dealing with payday loan debt?

To enhance your credit score, focus on making timely repayments, reducing existing debt, and maintaining responsible borrowing habits.

What should I consider before taking out a payday loan?

Before obtaining a payday loan, assess your financial situation, explore alternative borrowing options, and create a clear repayment plan to avoid falling into debt traps.

Gavin Harper is an accomplished author specializing in informative content on payday loans in Mississippi. With a keen focus on financial literacy, he provides readers with valuable insights and guidance on navigating the complexities of short-term loans. Through his writing, Gavin aims to empower individuals to make informed decisions about their financial futures and understand the implications of borrowing.

This post really sheds light on an often-overlooked aspect of personal finance. Growing up in Mississippi, I’ve seen firsthand how the landscape of payday loans can trap well-meaning individuals in cycles of debt, especially when money is tight. It’s fascinating—and a little frustrating—that while federal regulations aim to protect us, they often fall short of addressing the unique challenges we face in our state.

It’s true; the reality of payday loans can be really tough, especially in places like Mississippi where financial options seem limited. The cycle of debt you mentioned is something many face, often to cover unexpected expenses or bridge gaps. It’s frustrating that despite regulations, there aren’t enough tailor-made solutions that connect with the unique challenges here.

You’ve really touched on some important points. The cycle of debt can feel overwhelming, especially in places like Mississippi. I’ve seen firsthand how people end up trapped in these predatory lending situations, often because there just aren’t many viable alternatives. It’s like a catch-22: unexpected expenses arise, and payday loans just seem like the only option.

It’s insightful to hear about your experiences in Mississippi. So many people don’t realize how payday loans can ensnare individuals in difficult financial situations. It’s not just about borrowing money; it’s the endless cycle of fees and interest that makes it such a tough spot to escape.

This is a crucial discussion, particularly given the economic landscape in Mississippi, where high-interest lending can significantly impact the financial stability of individuals and families. The nuances between federal and state regulations really underscore the importance of localized understanding in these matters. I’ve always believed that while federal laws provide a foundational framework for consumer protection, state regulations are vital in addressing specific vulnerabilities faced by residents.

You’ve touched on a really essential point about how high-interest lending can affect people’s daily lives, especially in a place like Mississippi. It’s not just about laws on paper; it’s about how those laws interact with the everyday circumstances families find themselves in.

It’s interesting to read about the payday loan landscape in Mississippi, especially considering how many people rely on these options due to financial necessity. I’ve seen firsthand how easy it is to fall into the cycle of debt when taking out a payday loan—one unexpected expense can lead to another loan just to cover the previous one.

It’s great to hear that you found the discussion on the payday loan scene in Mississippi interesting. You’re spot on about how many people find themselves in a tough spot, feeling like they have no choice but to turn to these loans. The cycle you mentioned is something I’ve seen many times as well. Just one unforeseen expense—a medical bill, car repair, or even an unexpected job loss—can quickly snowball into taking out more loans, which can lead to a never-ending loop of debt.

Your exploration of payday loan regulations in Mississippi opens up a significant conversation about the intersection of financial practices and consumer protection. It’s striking to consider how state regulations cater to the diverse economic realities faced by residents, especially in an era where financial literacy remains crucial yet often overlooked.

You’ve raised such an important point about the intersection of financial practices and consumer protection, particularly in a state like Mississippi where the economic landscape is so varied. It’s a reminder that regulations often reflect not just the needs of the present but also the historical context of a region. Many residents might find themselves navigating financial challenges that aren’t immediately visible to outsiders, making the role of state regulations all the more crucial.

It’s intriguing how payday loan regulations can significantly shape the financial landscape in a state like Mississippi. I’ve seen firsthand how the lack of stringent regulations can trap individuals in cycles of debt. For instance, a friend of mine struggled with a payday loan that seemed harmless at first but quickly escalated due to hidden fees and high interest rates. It’s fascinating to consider how states might tailor their regulations not just to protect consumers but to reflect local economic realities.

You bring up such a crucial point about the impact of payday loan regulations, especially in Mississippi. It’s really eye-opening to hear how your friend’s experience unfolded. So many people find themselves in a similar situation without fully grasping the costs that can spiral out of control. Those hidden fees can often feel like they come out of nowhere, making a seemingly harmless loan turn into a monumental burden.

It’s really a tough situation when you see how payday loans play out in real life. Your friend’s experience is unfortunately a common story. Many people think they’re just a quick fix, but those hidden fees and sky-high interest rates can really put folks in a bind before they even realize it.

You’ve captured a tough reality that too many people face. It’s easy to see how payday loans can seem like a lifeline in the moment, especially when unexpected expenses pop up. Your friend’s experience highlights just how quickly those initial relief feelings can turn into stress. It’s frustrating that the fees and interest often sneak up unnoticed, trapping people in a cycle that feels impossible to escape.

You raise some important points about the role of payday loan regulations and their impact on individuals in Mississippi. The experiences you’ve shared highlight a situation that many people find themselves in; a seemingly simple loan turns into a tangled web of debt because of interest rates that can spiral out of control. It’s troubling to see how quickly a loan can transform from a way to bridge a temporary gap in finances into a long-term financial burden.

Navigating payday loans truly feels a bit like trying to dance at a wedding while balancing a plate of food, right? One wrong move and you might end up regretting it for a while! And in Mississippi, where the financial landscape is as diverse as our BBQ styles, knowing those regulations is key.

Navigating payday loans really can feel like a bit of a dance, can’t it? It’s all about balance and knowing your steps. And just like at a wedding, you don’t want that plate of food to end up on the floor when you misstep. The reality is that payday loans can be super tempting, especially in a place like Mississippi where the options vary as widely as our BBQ joints.

You hit the nail on the head with that dance analogy. It really is a tricky balance when it comes to payday loans, especially in a place like Mississippi where regulations can feel as varied as our BBQ styles. Just when you think you’ve got it figured out, something throws you off balance, and it can lead to some regrettable decisions.

The interplay between federal and state regulations on payday lending truly reflects the complexities of consumer protection in a diverse economic landscape like Mississippi. Your emphasis on understanding local regulations is particularly pertinent, given the state’s unique demographic challenges.

It’s fascinating how state regulations can really shape the payday loan landscape, especially in a place like Mississippi. I’ve often thought about how the same product can have such vastly different implications depending on where you live. For instance, I recently read about how some states have capped interest rates to prevent exploitation, while others have let the industry thrive unchecked. It really hits home how important it is for borrowers to not only understand their rights but also to advocate for better regulations that protect them.

You raise some really important points about how regulations can shape the payday loan landscape, especially in states like Mississippi. It’s interesting to see how varying levels of oversight can lead to dramatically different experiences for borrowers. In places with strict interest rate caps, borrowers often have a bit more breathing room, while in areas with little regulation, the consequences can be quite harsh.

You’ve touched on a critical aspect of the payday loan conversation—how much the patchwork of state regulations impacts not just the industry as a whole but real people in their everyday lives. It’s really striking to think about how individuals in Mississippi or any other state are navigating such different environments when it comes to accessing credit. Those variations can result in drastically different outcomes for borrowers.

It’s interesting to reflect on the human side of payday lending regulations. While the federal laws provide some basic protections, it feels like there’s a significant gap when it comes to addressing the specific needs of borrowers in states like Mississippi. Many individuals turn to payday loans not just out of choice but because of limited options for immediate financial relief, which reflects broader socioeconomic challenges.

You bring up an important point about the human side of payday lending. It’s easy to forget that behind those statistics are real people facing tough choices. In places like Mississippi, the reality is that many folks might feel trapped between a rock and a hard place when it comes to their finances.

Your exploration of payday loan regulations in Mississippi shines a much-needed light on a complex yet critical topic. I’ve seen firsthand how vulnerable populations can become ensnared in high-interest loans, often leading to a cycle of debt that’s incredibly hard to escape. It’s fascinating how federal regulations like the Truth in Lending Act provide a foundational safety net, yet the local nuances can make a significant difference in consumer protection.

It’s interesting to see how the landscape of payday lending varies so significantly from one state to another. Living in Mississippi, I’ve personally seen how tough finances can be for many people, and payday loans might seem like a lifeline during difficult times. However, when looking deeper into the regulations, it’s clear that these loans can also lead to a cycle of debt that’s hard to escape.