Key Insights

- Credit Report: A credit report contains an individual’s financial history, crucial for assessing creditworthiness.

- Credit Score: Credit scores are influenced by factors like payment history and credit utilization, impacting financial opportunities.

- Monitoring: Regular credit monitoring is vital for retirees to detect errors and protect against fraud.

- Common Issues: Common credit problems for retirees include high debt levels and late payments, which can severely affect credit scores.

Understanding Credit Reports and Scores

What Is a Credit Report?

A credit report is a comprehensive document created by credit reporting agencies that outlines an individual’s credit history. This report includes information about loans, credit cards, payment history, and public records such as bankruptcies. Lenders utilize credit reports to evaluate a person’s creditworthiness, determining whether to extend credit or loans. In Mississippi, just as in other parts of the United States, maintaining an accurate credit report is vital for retirees who may rely on fixed incomes and aim for financial stability during retirement.

For retirees in Mississippi, understanding what comprises a credit report can empower them to take control of their financial future. Each credit report is divided into sections — personal information, account information, public records, and inquiries. Regularly reviewing these sections can help retirees identify any inaccuracies that could hinder their financial opportunities, such as obtaining loans or mortgages for retirement homes.

How Are Credit Scores Calculated?

Credit scores are numerical representations of an individual’s creditworthiness, calculated using various factors, each contributing to the total score. The main components include payment history (35%), credit utilization (30%), length of credit history (15%), types of credit in use (10%), and recent credit inquiries (10%). For Mississippi retirees, understanding how these factors interact can help them take actionable steps to improve their credit scores and, consequently, their financial health.

For instance, timely payments can significantly boost a retiree’s credit score, while high credit utilization can negatively impact it. Retirees should aim to maintain their credit utilization below 30% to ensure a favorable score. Moreover, the length of credit history can be particularly relevant for retirees, as older accounts generally contribute positively to credit scores. By adopting these practices, retirees not only boost their credit scores but also enhance their chances of securing favorable financing options when needed.

Importance of Regular Credit Monitoring

Regular credit monitoring is essential for maintaining good financial health, especially for retirees living in Mississippi. Monitoring helps detect errors, potential fraud, and any significant changes in credit scores that could affect financial decisions. For a retiree, where fixed income and medical expenses may pose challenges, staying alert to their credit status becomes paramount.

Engaging in credit monitoring allows retirees to identify discrepancies that might arise from identity theft or reporting mistakes. By reviewing their credit reports at least once a year, they can ensure all information is accurate, which is crucial for maintaining or improving their credit scores. Many services provide free monitoring and alerts, which can help retirees stay informed and proactive in resolving any issues, thereby safeguarding their financial future.

Common Credit Issues Among Retirees

What Are the Most Common Credit Problems?

Common credit problems facing retirees include high debt levels, late payments, and the risk of identity theft. With limited income during retirement, managing debt becomes increasingly important. Retirees might find themselves struggling with existing debts from their working years, affecting their credit scores. Understanding these issues allows retirees to take proactive steps to improve their credit status and overall financial health.

Moreover, late payments can severely damage a retiree’s credit score, particularly if they stem from mismanagement of bills or unforeseen financial hardships. Identity theft poses another significant threat, potentially leading to unauthorized accounts opened in the retiree’s name, causing unnecessary stress and financial strain. By being aware of these common issues, retirees can implement strategies to mitigate their effects and maintain good credit health.

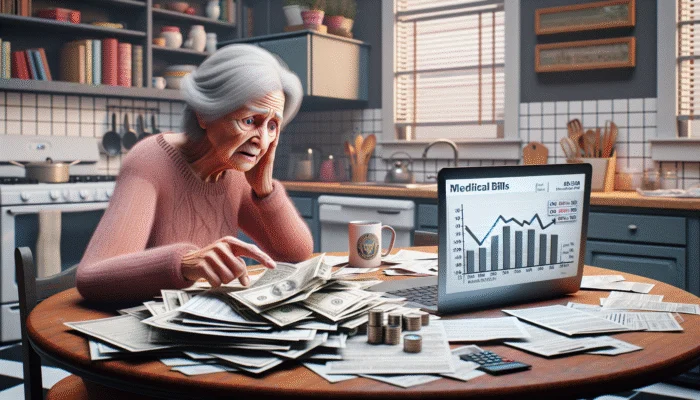

How Do Medical Bills Affect Credit?

Medical bills can have a profound impact on a retiree’s credit score if they are sent to collections. For many retirees in Mississippi, medical expenses can be substantial, often arising unexpectedly from health issues. If these bills remain unpaid, they can lead to negative entries on credit reports, significantly lowering credit scores. Thus, addressing medical bills promptly is essential to avoid damaging one’s credit profile.

Retirees should explore options such as payment plans or negotiating medical bills before they escalate to collections. Many hospitals and medical providers offer financial assistance programs that can help mitigate costs. By taking proactive measures to manage medical debts, retirees can protect their credit scores and ensure that unexpected healthcare expenses do not derail their financial stability during retirement.

Impact of Retirement on Credit

Retirement can significantly alter income levels, affecting a retiree’s ability to manage debt and maintain a good credit score. With a fixed income, retirees may find it challenging to keep up with monthly payments or manage existing debts, leading to potential credit issues. This shift necessitates careful planning to mitigate adverse effects on their credit scores and financial well-being.

Planning ahead can involve creating a realistic budget that accounts for fixed income and essential expenses. Emphasizing debt reduction strategies, such as prioritizing high-interest debts, can also be beneficial. Additionally, retirees should focus on making timely payments to existing debts, which is crucial for preserving their credit scores and ensuring that they can continue to access financial resources as needed.

How Can Retirees Improve Their Credit Scores?

Retirees can take several concrete steps to improve their credit scores. This includes paying bills on time, reducing debt, and regularly monitoring credit reports for inaccuracies. By adopting these practices, retirees can enhance their financial stability during their retirement years. Here is a bullet list of key actions they can take:

- Pay all bills, including credit cards and loans, on time to avoid late fees.

- Reduce outstanding debt by focusing on high-interest accounts first.

- Utilize automatic payments or reminders to manage due dates effectively.

- Review credit reports for errors and dispute inaccuracies promptly.

- Limit new credit inquiries to safeguard credit scores.

- Consider consolidating debts for easier management.

- Engage in financial education to understand credit dynamics better.

- Seek advice from financial professionals for personalized strategies.

By taking these steps, Mississippi retirees can markedly improve their credit scores, leading to better loan options, lower interest rates, and overall enhanced financial security in retirement.

Expert Insights on Top Credit Repair Strategies for Mississippi Retirees

How Can Retirees Improve Their Credit Scores?

Improving credit scores is a critical task for retirees, as it directly impacts their financial options and stability. Key steps include ensuring timely bill payments, reducing outstanding debt levels, and disputing any inaccuracies found on credit reports. Each action plays a vital role in rebuilding credit health. Below is a bullet list of the primary strategies retirees can implement:

- Establish a routine for tracking and paying bills on time.

- Focus on paying down credit card balances and loans systematically.

- Regularly check credit reports to identify and resolve discrepancies.

- Utilize credit tools like secured credit cards to improve scores.

- Limit usage of credit cards to maintain low utilization rates.

- Consider working with financial advisors for tailored guidance.

- Engage in credit education workshops to stay informed.

- Develop a long-term financial plan that prioritizes credit health.

By following these strategies, retirees can experience substantial improvements in their credit scores, enhancing their financial opportunities in retirement. These efforts not only pave the way for better access to credit but also contribute to overall peace of mind regarding financial matters.

What Are the Best Credit Repair Companies?

Selecting a reputable credit repair company can be incredibly beneficial for retirees seeking to improve their credit scores. The right company will possess a proven track record of success and positive client reviews. In Mississippi, several credit repair companies stand out for their effective services tailored to the needs of retirees. Here’s a bullet list of top credit repair companies in Mississippi:

- CreditRepair.com: Known for personalized credit repair strategies.

- Lexington Law: Offers comprehensive services and a track record of success.

- Sky Blue Credit: Recognized for its exceptional customer service.

- Ovative Group: Focuses on transparency and ethical practices.

- Goodbye Credit: Specializes in helping retirees navigate credit challenges.

- MyCreditGroup: Known for its tailored approach to credit repair.

- Pacific Credit Repair: Provides extensive resources and guidance.

- Credit Saint: Offers robust services with a focus on obtaining results.

When choosing a credit repair company, retirees should conduct thorough research to find a company that aligns with their specific needs. By selecting a reliable service, they can save time and potentially achieve better results in their credit repair journey.

Importance of Professional Credit Repair Services

Professional credit repair services provide a significant advantage for retirees aiming to improve their credit scores. These companies offer personalized strategies and manage disputes on behalf of clients, saving time and typically producing more effective results. Given the complexities involved in understanding credit reports and the dispute process, the expertise of professionals can be invaluable.

Many retirees may not have the knowledge or time to navigate the intricacies of credit repair. A professional service can analyze the credit report in detail, identify areas for improvement, and develop a tailored action plan. For instance, they may negotiate with creditors or dispute inaccurate entries. This hands-on approach can yield quicker results and alleviate the stress associated with managing credit issues, making it a wise investment for retirees seeking financial stability.

How Can Mississippi Retirees Protect Their Credit?

Protecting credit is essential for retirees, especially in a digital age where identity theft is prevalent. Implementing protective measures can help mitigate risks and maintain a healthy credit profile. Here are several strategies retirees can adopt to safeguard their credit:

- Regularly monitor credit reports from all three major bureaus.

- Set up fraud alerts on credit reports if suspicious activity is suspected.

- Utilize strong passwords and two-factor authentication for online accounts.

- Be cautious when sharing personal information, especially online.

- Consider signing up for credit monitoring services.

- Shred documents containing sensitive information before disposal.

- Stay informed about common scams targeting retirees.

- Keep a close eye on bank and credit card statements for unauthorized charges.

By taking these proactive measures, Mississippi retirees can fortify their credit against potential threats that could derail their financial stability. Awareness and vigilance are key components of effective credit protection, ensuring that retirees can enjoy their retirement years without undue financial stress.

What Are the Legal Rights of Retirees Regarding Credit Repair?

Mississippi retirees possess specific legal rights under the Fair Credit Reporting Act (FCRA) that empower them to dispute inaccuracies in their credit reports and seek redress for violations. Understanding these rights is crucial for navigating the credit repair process effectively. The FCRA provides consumers the right to access their credit reports, dispute incorrect information, and ensure the accuracy of their credit history.

Retirees have the right to review their credit reports at least once a year for free from each of the three major credit bureaus. If they identify discrepancies, they can dispute them directly with the credit reporting agency. Additionally, if a consumer’s rights are violated, they can take legal action against the credit reporting agency or the entity that provided incorrect information. Knowing these rights empowers retirees to take charge of their credit repair efforts, ensuring they have the tools and resources to maintain their financial health.

DIY Credit Repair Techniques

How to Dispute Errors on Your Credit Report

Disputing errors on a credit report is a crucial step in the credit repair process. Retirees can take charge by identifying inaccuracies and formally disputing them with credit bureaus. The process can be conducted online or via mail, ensuring that retirees have multiple avenues for addressing these issues. To successfully dispute errors, retirees should follow these steps:

- Obtain a copy of your credit report from each of the three major bureaus.

- Identify any inaccuracies or discrepancies in the report.

- Gather supporting documentation that evidences the errors.

- Contact the relevant credit bureau, either online or by mail, to file a dispute.

- Clearly outline the inaccuracies and include copies of supporting documents.

- Await a response, which the bureau is required to provide within 30 days.

- Follow up if needed, especially if the errors are not corrected.

- Keep records of all correspondence related to the dispute.

By diligently disputing inaccuracies, Mississippi retirees can improve their credit scores and ensure their credit reports accurately reflect their financial responsibilities. This proactive approach is essential for maintaining a strong credit profile and facilitating future financial opportunities.

Strategies for Reducing Debt

Reducing debt is a fundamental aspect of improving credit health, especially for retirees who may be managing a fixed income. Developing a manageable budget is the first step toward effective debt reduction. Retirees should prioritize high-interest debts, such as credit cards, and focus on strategies that yield the most significant impact on their overall financial situation. Here are some effective strategies for reducing debt:

- Create a comprehensive budget that outlines income and expenses.

- Identify and prioritize high-interest debts to pay off first.

- Consider consolidating debts for easier management and lower interest rates.

- Negotiate with creditors for more favorable repayment terms.

- Implement the snowball method—paying off smaller debts first to build momentum.

- Utilize additional income sources, such as part-time work, to assist in debt payments.

- Seek assistance from credit counseling services to develop a tailored plan.

- Regularly review and adjust the budget as necessary to reflect changing financial circumstances.

By employing these strategies, Mississippi retirees can reduce their debt levels effectively, leading to improved credit scores and greater financial stability during retirement. Taking a proactive approach is vital for achieving long-term financial goals.

Building Positive Credit History

Building a positive credit history is essential for retirees looking to enhance their credit scores and financial standing. A solid credit history not only improves credit scores but also opens doors to better loan options and interest rates. Retirees can build positive credit by focusing on several key practices that contribute to their overall creditworthiness. Key strategies include:

- Making timely payments on all bills, including loans and credit cards.

- Keeping credit utilization below 30% of total credit limits.

- Diversifying credit types, such as installment loans and revolving credit.

- Establishing a long-term credit account to enhance credit history length.

- Utilizing secured credit cards to rebuild credit if necessary.

- Avoiding excessive credit inquiries that could signal financial distress.

- Engaging in responsible borrowing practices to maintain a good credit reputation.

- Monitoring credit scores regularly to track improvements and identify areas for growth.

By adopting these practices, Mississippi retirees can successfully build a positive credit history, leading to enhanced credit scores and greater financial opportunities in their retirement years.

Utilizing Credit-Building Tools

Utilizing credit-building tools can significantly aid retirees in enhancing their credit scores over time. Various financial instruments and strategies exist that can help retirees establish or rebuild their credit profiles effectively. Here’s an overview of some valuable credit-building tools that retirees can consider:

- Secured credit cards: These require a cash deposit that serves as collateral, making them a viable option for those with poor or limited credit history.

- Credit-builder loans: Offered by some banks and credit unions, these loans help build credit by requiring regular payments, which are reported to credit bureaus.

- Becoming an authorized user: Retirees can ask family members or trusted friends to add them as authorized users on their credit cards, benefiting from their positive credit history.

- Utilizing peer-to-peer lending platforms: These can provide an opportunity to secure small personal loans, which can be paid off promptly to build credit.

- Participating in credit counseling programs: These programs often include education on credit management and may offer access to special credit-building tools.

- Applying for retail credit cards: These often have more lenient approval requirements and can be a stepping stone to better credit.

- Regularly monitoring credit scores through various apps: Staying informed enables effective tracking of improvements and timely adjustments to strategies.

- Engaging in financial literacy workshops: Enhancing financial knowledge can lead to better credit management practices.

By leveraging these tools, Mississippi retirees can steadily improve their credit scores, paving the way for healthier financial futures and access to better credit opportunities.

Legal Rights and Protections

What Are Your Rights Under the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) grants consumers specific rights regarding their credit reports, which are particularly relevant for retirees striving for financial stability. Among these rights is the ability to dispute inaccurate or incomplete information contained within a credit report. Understanding these rights is essential for Mississippi retirees looking to maintain or improve their credit status.

Retirees have the right to access their credit reports for free at least once a year from each of the three major credit bureaus. This access allows them to identify any inaccuracies that could negatively impact their credit scores. If discrepancies are found, retirees can file disputes, and credit reporting agencies are required to investigate the claims within 30 days. Furthermore, the FCRA prohibits discrimination based on credit history, protecting retirees from unfair treatment in lending and insurance practices. By understanding and exercising these rights, Mississippi retirees can actively manage their credit health and assert their consumer rights.

How to Protect Yourself from Credit Scams

Protecting oneself from credit scams is paramount for retirees, especially given their potential vulnerability in today’s digital landscape. Scammers often target older adults, employing tactics that can lead to identity theft or fraudulent credit activities. To safeguard against such scams, retirees should adopt several precautionary measures:

- Be cautious of unsolicited offers via phone, email, or mail that promise quick credit repair.

- Research companies thoroughly before engaging in any credit repair services.

- Avoid providing personal information, like Social Security numbers, unless absolutely necessary and verified.

- Never pay upfront fees for credit repair services; legitimate companies charge only after services are rendered.

- Regularly monitor credit reports for any unfamiliar accounts or inquiries.

- Educate yourself about common scams targeting seniors to recognize red flags.

- Utilize two-factor authentication for online financial accounts when possible.

- Report any suspicious activity to local authorities or consumer protection agencies.

By taking these protective measures, Mississippi retirees can minimize their risk of falling victim to credit scams, thus preserving their credit health and financial security.

Understanding the Statute of Limitations on Debt

The statute of limitations on debt varies by state and defines the timeframe within which creditors can legally pursue debt collection. For Mississippi retirees, understanding this statute is crucial for managing old debts and ensuring these do not adversely affect their credit reports. In Mississippi, the statute of limitations for most consumer debts is three years, meaning creditors cannot sue for the collection of debts after this period.

This knowledge empowers retirees to make informed decisions regarding old debts. Once the statute of limitations has passed, retirees can assert their rights and may not be compelled to pay these debts. However, it’s essential to note that debts may still appear on credit reports for up to seven years. Being aware of these timelines can help retirees manage their debt effectively while protecting their credit in the long run.

Financial Planning for Credit Health

How Can Budgeting Help Improve Credit?

Budgeting is a fundamental tool that plays a vital role in improving credit health, particularly for retirees on a fixed income. A well-structured budget allows retirees to manage their finances strategically, ensuring that they can pay bills on time and reduce debt effectively. Creating a budget requires listing all sources of income and categorizing expenses, which helps retirees identify areas where they can cut back and allocate funds toward debt repayment.

By adhering to a budget, retirees can prioritize timely payments for credit obligations, which is critical for maintaining a healthy credit score. Additionally, budgeting enables retirees to set aside funds for emergency expenses, reducing the likelihood of incurring more debt. This financial discipline fosters a proactive approach to credit management, essential for longevity and stability in retirement.

Importance of an Emergency Fund

An emergency fund serves as a financial safety net that can protect retirees from unexpected expenses, such as medical bills or home repairs. For retirees, having this fund is crucial, as it prevents them from relying on credit cards or loans to cover sudden costs, which can lead to increased debt and potentially harm their credit scores. An emergency fund should ideally cover three to six months’ worth of living expenses, providing reassurance and financial security during unforeseen circumstances.

By establishing an emergency fund, Mississippi retirees can safeguard their credit health, as they will not have to resort to borrowing or incurring debt in times of crisis. This proactive financial planning enables retirees to maintain a stable financial environment, enhancing their peace of mind and overall quality of life during retirement.

Long-Term Financial Strategies for Retirees

Long-term financial strategies are essential for preserving credit health and financial stability throughout retirement. Retirees should focus on several key strategies, such as saving for unexpected expenses, investing wisely, and planning for healthcare costs. By taking a comprehensive approach to financial planning, retirees can better manage their resources and ensure a secure financial future.

Saving for retirement should include allocating funds toward investments that generate passive income, such as stocks or mutual funds. Diversifying investments not only mitigates risks but also enhances potential returns. Moreover, planning for healthcare costs is crucial, as medical expenses can quickly deplete savings. By considering long-term care insurance or health savings accounts, retirees can prepare for these expenses without jeopardizing their credit health.

In summary, implementing these long-term financial strategies empowers Mississippi retirees to maintain credit health while enjoying their retirement years with greater financial confidence.

Trusted Strategies for Top Credit Repair Strategies for Mississippi Retirees

What Are the Most Effective Credit Repair Methods?

Effective credit repair methods encompass various strategies that retirees can implement to improve their credit scores significantly. Common approaches include disputing errors on credit reports, negotiating with creditors for better terms, and utilizing professional credit repair services. These methods have proven successful for many retirees seeking to enhance their financial standing. Below are some real-world examples of successful credit repair in Mississippi:

- Several retirees have successfully disputed inaccuracies on their credit reports, resulting in improved scores and access to lower interest rates on loans.

- Negotiating with creditors has helped many retirees secure reduced payments or lower interest rates, easing their financial burden.

- Engaging with credit repair services has enabled retirees to receive personalized strategies that led to faster improvements in their credit scores.

- Some retirees have benefited from educational workshops that provided insights into effective credit management practices, leading to better financial decision-making.

- Utilizing budgeting tools has allowed retirees to track expenses and allocate funds, resulting in timely payments and credit score improvements over time.

- Retirees have reported improved access to credit cards and loans after actively managing their credit profiles.

- Community financial advice centers have helped retirees navigate complex credit issues and understand their rights under the FCRA.

- Retirees leveraging secured credit cards have successfully rebuilt their credit scores by demonstrating responsible credit usage.

These examples illustrate the effectiveness of various credit repair methods, empowering Mississippi retirees to take charge of their financial futures through informed decision-making and proactive credit management.

How to Choose the Right Credit Repair Plan

Choosing the right credit repair plan involves assessing individual financial situations and understanding available options. Retirees should evaluate their specific needs, set realistic goals, and comprehend the services offered by credit repair companies. A well-informed choice can dramatically improve credit scores and overall financial health.

When considering a credit repair plan, retirees should begin by analyzing their current credit reports to identify areas for improvement. Setting clear goals, such as raising credit scores by a certain number of points or disputing a specific number of inaccuracies, helps create a focused approach. Additionally, researching credit repair companies that align with those goals is crucial. Reading reviews and testimonials can provide insights into a company’s effectiveness and reliability. By carefully selecting a plan that meets their needs, retirees can navigate the credit repair process more effectively and achieve their desired financial outcomes.

Maintaining Good Credit After Repair

Maintaining good credit after repairing credit is essential for ensuring long-term financial stability, particularly for Mississippi retirees. After successfully improving their credit scores, retirees must adopt responsible credit management practices to sustain their progress. Here are some actionable steps for retirees to follow:

- Consistently pay all bills on time to avoid late payments.

- Monitor credit reports regularly to ensure accuracy and address any discrepancies.

- Keep credit utilization below 30% by managing credit card balances effectively.

- Avoid taking on unnecessary debt by making informed financial decisions.

- Continue educating oneself about credit management and financial planning.

- Limit new credit inquiries, which can negatively impact credit scores.

- Utilize tools such as budgeting apps to track expenses and stay on top of payments.

- Seek professional advice when making significant financial decisions that could affect credit health.

By implementing these steps, Mississippi retirees can effectively maintain good credit and enjoy the financial benefits that come with a solid credit history, fostering peace of mind during retirement.

How Mississippi Retirees Can Benefit from Credit Repair

Credit repair offers numerous benefits for retirees in Mississippi, improving their financial outlook and reducing stress associated with financial decision-making. Some of the most notable benefits include enhanced loan approval rates, reduced interest rates, and increased financial stability. Retirees who successfully repair their credit can access better financing options, making it easier to secure loans for major purchases or unexpected expenses.

For example, retirees with improved credit scores may qualify for lower interest rates on mortgages, allowing them to save money over time. Additionally, having a stronger credit profile can increase confidence when applying for rental housing or credit cards, broadening available options. Ultimately, credit repair can lead to a more secure retirement, where financial stress is minimized, and opportunities for enjoyment and fulfillment are maximized. The commitment to repairing credit is a significant step toward achieving lasting financial health.

Legal Considerations for Credit Repair in Mississippi

Understanding legal considerations surrounding credit repair is essential for Mississippi retirees seeking to navigate this process effectively. Retirees should be aware of specific state laws and regulations that govern credit repair practices, ensuring they engage in safe and effective credit repair strategies. Mississippi law emphasizes consumer protection, particularly regarding deceptive practices in the credit repair industry.

Retirees should familiarize themselves with their rights under the Fair Credit Reporting Act (FCRA), which provides guidelines for disputing inaccuracies and accessing credit reports. Additionally, before engaging with a credit repair service, it is crucial to verify the company’s legitimacy, including checking for any complaints filed with the Better Business Bureau. Understanding these legal aspects not only helps retirees protect themselves from potential scams but also empowers them to assert their rights effectively, ensuring a smoother credit repair process.

Impact of Credit on Retirement Lifestyle

How Does Credit Affect Your Retirement Plans?

Good credit plays a pivotal role in shaping retirement plans, directly influencing the ability to secure loans, rent housing, and even impacting insurance rates. For Mississippi retirees, maintaining a strong credit profile can open doors to various financial opportunities, ensuring a comfortable and fulfilling retirement lifestyle. A solid credit score can enhance access to financing for major purchases, such as homes or vehicles, making it easier to invest in a quality living environment.

Moreover, good credit can result in lower interest rates on loans and mortgages, significantly affecting monthly payments and long-term affordability. Additionally, insurance companies often base premiums on credit scores, meaning retirees with better credit might secure lower rates for auto and homeowners insurance. Thus, credit has a far-reaching impact on retirees’ financial circumstances, emphasizing the need for proactive credit management throughout retirement.

Importance of Credit for Healthcare Financing

Good credit is essential for financing healthcare costs, particularly for retirees who may face increasing medical expenses as they age. A solid credit score can provide retirees with access to loans or credit cards specifically designed for healthcare financing, allowing them to manage costs without depleting savings. Retirees should understand the importance of maintaining good credit to ensure they have options when dealing with unexpected health-related expenses.

Retirees can benefit from medical credit cards or personal loans that facilitate paying for healthcare services upfront, thereby reducing financial stress and allowing for timely treatment. Good credit can also lead to better insurance options, which can alleviate some of the financial burdens associated with healthcare costs. Ultimately, by prioritizing credit health, retirees can navigate the complexities of healthcare financing more effectively and ensure their well-being during retirement.

Planning for Credit in Long-Term Care

Long-term care can be a significant financial burden for retirees, making good credit an invaluable asset when securing financing or insurance to cover these costs. Retirees should consider incorporating credit health into their long-term care planning, as it can facilitate access to necessary resources. Proper planning can include researching long-term care insurance options and understanding how credit scores can influence premiums and eligibility.

By maintaining a strong credit profile, retirees can enhance their chances of qualifying for favorable long-term care insurance plans that cover essential services. Additionally, good credit can provide access to personal loans or lines of credit that can be used for long-term care expenses, ensuring retirees are financially prepared for future needs. In this light, incorporating credit management into long-term care planning is vital for achieving financial security and peace of mind throughout retirement.

Resources and Support for Mississippi Retirees

What Local Resources Are Available?

Local resources in Mississippi can significantly aid retirees in their credit repair and financial management efforts. Various services, credit counseling agencies, and community organizations offer support, guidance, and education tailored to retirees. Retirees should explore options such as credit counseling services, which often provide personalized plans for managing debt and improving credit scores.

Additionally, financial education workshops can equip retirees with essential knowledge regarding budgeting, debt management, and credit repair strategies. Local retiree support groups may also offer resources and shared experiences that foster financial literacy and empowerment. By tapping into these local resources, Mississippi retirees can enhance their financial well-being and make informed decisions regarding their credit health.

How to Access Free Credit Reports

Accessing free credit reports is an essential practice for retirees to monitor their credit health and identify inaccuracies. Retirees are entitled to receive one free credit report annually from each of the three major credit bureaus: Experian, TransUnion, and Equifax. To obtain these reports, retirees can visit AnnualCreditReport.com, the official site authorized by federal law.

It is advisable for retirees to stagger their requests throughout the year, enabling them to monitor their credit profiles more consistently. By carefully reviewing their credit reports, retirees can identify any discrepancies or fraudulent activities that may need addressing, thus taking proactive steps to protect their credit health. Accessing free credit reports is a fundamental aspect of credit management and should be a regular part of every retiree’s financial routine.

Connecting with Financial Advisors

Financial advisors can provide Mississippi retirees with personalized advice on credit repair, debt management, and retirement planning. These professionals bring expertise that can help retirees navigate complex financial landscapes, ensuring they make informed decisions about their credit and overall financial health. When connecting with a financial advisor, retirees should look for individuals or firms that specialize in retirement planning and have experience with credit repair strategies.

Collaborating with a financial advisor allows retirees to develop tailored plans that address their unique financial situations. Advisors can provide insights on budgeting, investment strategies, and credit management, enabling retirees to maximize their resources and achieve their financial goals. By leveraging the expertise of a financial advisor, Mississippi retirees can enhance their financial well-being and build a secure future.

FAQs

What is a credit report?

A credit report is a detailed record of your credit history, including loans, credit cards, and payment history, used by lenders to assess creditworthiness.

How often should I check my credit report?

You should check your credit report at least once a year to detect errors, fraud, or changes in your credit score.

What factors impact my credit score?

Key factors impacting your credit score include payment history, credit utilization, length of credit history, types of credit, and recent inquiries.

Can medical bills affect my credit score?

Yes, unpaid medical bills can negatively impact your credit score if they go to collections.

What are my rights under the Fair Credit Reporting Act?

You have the right to dispute inaccuracies, access your credit report, and seek legal recourse for violations under the Fair Credit Reporting Act.

How can I dispute an error on my credit report?

To dispute an error, obtain your credit report, identify inaccuracies, gather evidence, and file a dispute with the credit bureau online or by mail.

What strategies can I use to reduce debt?

Effective strategies for reducing debt include creating a budget, prioritizing high-interest debts, consolidating loans, and negotiating with creditors.

What is the importance of credit for retirees?

Good credit affects retirees’ ability to secure loans, rent housing, and can influence insurance rates, impacting their overall financial health.

How can credit repair services help me?

Credit repair services can help identify inaccuracies, manage disputes, and provide personalized strategies to improve your credit score efficiently.

What local resources are available for retirees in Mississippi?

Local resources include credit counseling services, financial education workshops, and retiree support groups that offer guidance on credit management and financial planning.

See also: Jackson, MS.

A Mississippi-based financial consultant with over a decade of experience in personal finance and payday lending. Originally from Jackson, he holds certifications in financial planning and credit advisory. Passionate about helping everyday Americans make smarter borrowing decisions, he focuses on guiding people away from common debt traps while promoting healthy financial habits. His expertise bridges the gap between short-term loan needs and long-term money management strategies. Outside of work, he volunteers with local programs that promote financial literacy across Mississippi.

Your exploration of credit reports and their significance for retirees highlights a critical, often overlooked aspect of financial health. As we age, maintaining a strong credit profile becomes even more crucial in securing favorable terms for loans or other financial services that might arise, whether it’s for healthcare expenses or unexpected needs. It’s interesting to see how much individual factors like payment history and credit utilization weigh in on credit scores—these are lessons that, unfortunately, many people may overlook until they face challenges.

I appreciate the focus on credit reports and scores, especially for retirees. It’s a topic that often gets overlooked but can really impact one’s financial security in later years. I’ve seen friends struggle with late payments due to unexpected medical bills, highlighting the importance of monitoring your credit regularly. I wonder how technology, like mobile apps and automated alerts, could help retirees stay on top of these issues. It’s a lot to manage, but with the right tools and knowledge, it can become less daunting. What has everyone else found useful in managing their credit health as they age?

I appreciate the depth of your insights on credit reports and scores, especially their relevance to retirees. It’s an often underestimated aspect of financial health that can truly shape one’s retirement experience.

Your insights on credit reports and scores are particularly relevant for retirees navigating financial landscapes that often differ significantly from those of younger adults. As we age, managing credit becomes increasingly important, especially given the potential for fixed incomes and unexpected medical expenses.