Mississippi Payday Loan Borrower Behavior Trends

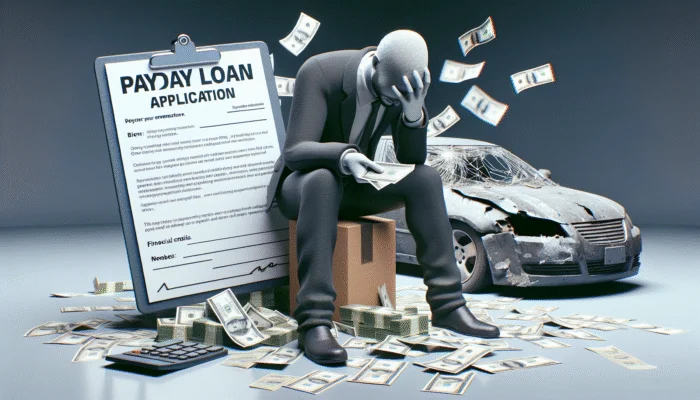

At a Glance Demand Surge: The demand for payday loans in Mississippi has increased due to economic instability and immediate […]

At a Glance Demand Surge: The demand for payday loans in Mississippi has increased due to economic instability and immediate […]

Borrower Trends are a comprehensive collection of expert resources covering the evolving behaviors and preferences of loan applicants across the nation.

At Kopitiamekonomi, we provide Loan Services nationwide, helping borrowers achieve financial confidence and peace of mind through transparent loan processes.

Understanding borrower trends gives you the advantage to make informed decisions without the uncertainty of hidden fees or unfavorable terms.

This category covers common borrower behaviors, regulatory changes, and emerging market insights.

As of 2025, understanding borrower trends is essential for navigating the loan landscape effectively. Recent industry changes have highlighted the importance of adapting to shifting consumer preferences, which are frequently paired with evolving financial products. Knowledge of these trends can significantly enhance your decision-making process when seeking loan services.

Key aspects of borrower trends include the influence of credit scores on loan approvals, the impact of interest rate fluctuations on borrower choices, and the role of financial education in shaping borrower behavior. Additionally, related topics include changes in federal lending regulations, consumer protection laws, and the effects of economic shifts on loan demand.

Borrower Trends provide insights into evolving loan applicant behaviors, helping Kopitiamekonomi enhance service offerings and improve borrower satisfaction nationwide.

Borrower Trends influence loan approvals by highlighting the importance of credit scores and borrower behaviors, which are critical factors in the decision-making process at Kopitiamekonomi.

Borrowers should consider how market trends, such as interest rates and regulatory changes, impact their loan options and financial decisions when working with Kopitiamekonomi.