Understanding Credit Scores in the US

What is a FICO score and how does it work in the US?

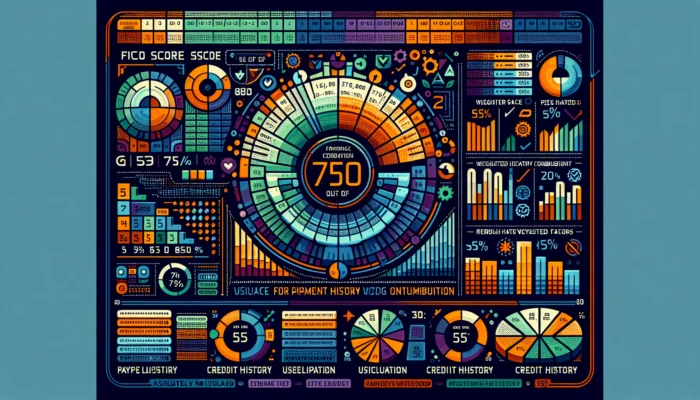

A FICO score is a critical three-digit number ranging from 300 to 850 that quantifies a consumer’s creditworthiness within the United States. This score plays a pivotal role in determining loan approvals, interest rates, and overall financial trustworthiness. The FICO scoring model evaluates five primary factors with specific weightings: payment history (35%), credit utilization (30%), length of credit history (15%), types of credit in use (10%), and new credit inquiries (10%). These components collectively reflect how responsibly an individual manages their credit.

Major credit bureaus such as Equifax, Experian, and TransUnion collect and compile financial data, which directly influences the FICO score. For example, a Mississippi resident who consistently pays bills on time might maintain a score near 740, signaling strong credit health. Conversely, late payments or defaults can cause a drop below 600, limiting access to favorable personal and payday loans. Understanding these dynamics is essential for consumers aiming to navigate the credit landscape effectively.

What key elements influence your credit report in the US?

Your credit report is a comprehensive record of your credit activity, maintained by the major US credit bureaus. It includes detailed information on your payment history, outstanding debts, credit inquiries, and account statuses. Timely payments on obligations such as mortgages, auto loans, and credit cards positively impact your credit score, signaling reliability to lenders. Conversely, missed payments, defaults, or collections can severely damage your credit profile.

Maintaining accurate and up-to-date records is crucial. Many consumers in Mississippi and across the US utilize credit monitoring apps to track changes in their reports and receive alerts about suspicious activity. These tools help users stay informed and proactive, enabling them to address potential issues quickly. For instance, a borrower who pays their personal loans and credit cards on time will see their credit report reflect this positive behavior, ultimately boosting their creditworthiness over time.

Why is credit utilization important in American finances?

Credit utilization refers to the ratio of your credit card balances to your total credit limits. It is one of the most influential factors in calculating your credit score in the US. Keeping this ratio below 30 percent is widely recommended by financial experts to maintain a healthy credit profile. High utilization signals potential financial stress to lenders, which can lower your score.

Effective strategies to manage credit utilization include budgeting carefully and avoiding unnecessary credit card spending. For example, if your total credit limit across all cards is $10,000, maintaining balances under $3,000 helps keep your utilization ratio in the optimal range. Below is a breakdown of common credit utilization ratios and their impact on credit health:

- 0% – 10%: Excellent utilization, highly favorable to lenders

- 11% – 20%: Good utilization, indicates responsible credit use

- 21% – 30%: Fair utilization, acceptable but room for improvement

- Above 30%: Poor utilization, may negatively affect credit scores

By tracking monthly expenses and planning larger purchases carefully, consumers in Mississippi and nationwide can maintain optimal credit utilization, enhancing their chances of loan approval and better interest rates.

How can you improve your credit score in the US?

Improving your credit score in the US requires a multifaceted approach focused on responsible financial habits. Key strategies include making timely payments, reducing existing debt balances, and disputing any inaccuracies on your credit reports from bureaus like Experian or Equifax. For example, a borrower who consistently pays bills on time can see their score increase from 580 to 720 within a year by following disciplined financial practices.

Another effective method is increasing your credit limits on existing cards, which lowers your credit utilization ratio without increasing spending. Additionally, disputing errors such as incorrect late payments or outdated accounts can result in immediate credit score improvements. Using credit monitoring tools helps track progress and alerts you to changes, empowering you to maintain and improve your credit health over time.

How do you monitor and protect your credit in the US?

Regularly monitoring your credit reports is essential for protecting your credit score in the US. Services like AnnualCreditReport.com provide consumers with free annual access to their reports from the three major bureaus. This allows early detection of fraud, errors, or identity theft. Setting up alerts with banks or credit card companies can notify you of unusual activity, adding an extra layer of security.

Understanding tools such as fraud alerts and credit freezes can further safeguard your identity and credit score. Many consumers have successfully prevented identity theft by promptly identifying unauthorized charges and freezing their credit accounts. Staying vigilant and using these protective measures can significantly reduce the risk of credit damage due to fraudulent activity.

How Can You Establish Credit Without Loans?

What steps should you take first in the US?

The initial step to establishing credit without taking out loans is to obtain and review your credit report from major US credit bureaus like TransUnion. This review provides insight into your current credit standing and highlights areas needing improvement. You can request free annual reports through AnnualCreditReport.com, ensuring you stay informed about any factors affecting your score. Understanding your report is essential under US privacy laws and empowers you to take proactive credit-building steps.

After reviewing your report, consider opening a checking or savings account or applying for a secured credit card. Secured cards require a deposit that serves as your credit limit, helping you build a payment history without incurring debt. Starting with small, manageable purchases that you can pay off monthly allows you to establish credit gradually and responsibly.

How does becoming an authorized user help build credit?

Becoming an authorized user on a family member’s credit card is an effective way to build credit in the US without taking on direct financial responsibility. This status allows you to benefit from the primary cardholder’s positive payment history, which reflects on your credit report. For example, a Mississippi resident added as an authorized user on a parent’s credit card with a strong payment record may see a notable improvement in their FICO score.

It is important to ensure the primary cardholder maintains responsible credit habits, as their financial behavior directly impacts your credit standing. This method provides a low-risk path to establishing credit, especially for young adults or those new to credit.

What alternative US banking products help build credit?

Secured credit cards offered by US banks are another practical option for building credit without traditional loans. These cards require a security deposit equal to the credit limit, such as a $500 deposit for a $500 credit limit. As you use the card and make timely payments, the bank reports this positive activity to credit bureaus, helping to build or rebuild your credit score.

Secured cards are particularly beneficial for individuals with limited or poor credit histories. Responsible use, including paying off balances in full each month, demonstrates good financial behavior and aligns with American credit reporting standards. Over time, this can open doors to unsecured credit products and better loan terms.

Expert Insights on Credit Score Improvement

How does payment history impact your score in America?

Payment history is the most influential factor in your credit score in the US, accounting for 35% of your FICO score. Late or missed payments on loans and credit cards can cause significant drops, sometimes exceeding 100 points. Therefore, making payments on time is critical to maintaining and improving your credit profile.

Adopting actionable steps such as setting up payment reminders or enrolling in automatic payments can greatly increase the likelihood of on-time payments. Additionally, engaging with credit counseling services provides personalized strategies for managing payments and budgeting effectively. For example, consumers who use reminders and counseling often experience steady credit score improvements reflecting their responsible financial management.

What is the effect of debt levels on American credit?

High debt levels, especially as measured by your debt-to-income ratio, can negatively affect your credit score. Lenders view a lower ratio as a sign of financial stability and less reliance on credit. Reducing debt through consolidation, such as using a personal loan to pay off high-interest credit cards, can improve your credit standing.

Here are effective US debt management strategies to reduce your debt burden:

- Create a budget prioritizing debt repayment

- Consider debt consolidation loans

- Use the snowball or avalanche repayment methods

- Consult a financial advisor for personalized plans

Implementing these approaches helps consumers manage debt responsibly, leading to gradual improvements in their credit scores.

Why does length of credit history matter domestically?

The length of your credit history significantly influences your credit score in the US. Older accounts demonstrate a longer track record of managing credit responsibly, which lenders view favorably. Closing old accounts can shorten your credit history and potentially lower your score.

Maintaining long-standing accounts and using them occasionally keeps your credit history active. Research on American consumer behavior shows that a diverse mix of credit accounts held over several years strengthens credit profiles. For example, a consumer with a credit card open for over ten years often enjoys a higher credit score due to this established history.

What Factors Most Affect US Credit Scores?

Understanding the primary factors that influence US credit scores helps consumers make informed decisions. These factors include:

- Payment history: Timely payments build trust with lenders

- Credit utilization: Keeping balances low relative to credit limits

- Length of credit history: Demonstrating long-term financial responsibility

- Types of credit: Managing a mix of revolving and installment credit

- New credit inquiries: Limiting the number of recent credit applications

Each factor contributes to your overall creditworthiness, affecting loan eligibility and interest rates, especially for personal and payday loans in Mississippi and beyond.

Research-Backed Strategies for US Credit Health

How to use budgeting tools effectively in the US?

US-based budgeting apps like Mint and You Need a Budget (YNAB) empower consumers to track expenses, create customized budgets, and set financial goals. These tools categorize spending, enabling users to monitor progress and avoid overspending. For instance, Mint allows users to set limits for categories such as groceries or entertainment, helping maintain financial discipline.

Using budgeting apps can reduce reliance on credit cards and prevent debt accumulation. Studies show that individuals who consistently use these tools experience better financial health and improved credit scores. By adopting a structured budgeting approach, consumers lay the groundwork for sustainable credit growth.

How does diversifying your credit mix improve your score?

Maintaining a diverse mix of credit types, including credit cards, auto loans, and mortgages, can enhance your credit score in the US. A balanced credit portfolio signals to lenders that you can manage various credit forms responsibly. For example, combining revolving credit (credit cards) with installment loans (car or personal loans) demonstrates financial versatility.

To diversify your credit mix, consider responsibly using different credit products while maintaining timely payments. Research indicates that consumers with varied credit experiences tend to have higher scores, making diversification a valuable strategy for credit health.

How can you monitor credit changes using US resources?

Regularly checking your credit report through US bureaus is vital for maintaining a healthy credit profile. Proactive monitoring helps detect errors or fraudulent activity early, preventing significant score drops. Free services offering credit updates and alerts enable consumers to stay informed about changes.

Experts emphasize understanding your credit report’s components and reviewing it frequently. Promptly addressing discrepancies ensures your credit score accurately reflects your financial behavior. Leveraging these resources empowers consumers to take control of their credit health.

Why Is Consistency Key in Credit Building?

What habits should you adopt for long-term gains?

Consistent financial habits such as making regular payments, budgeting effectively, and avoiding unnecessary debt build trust with lenders over time. These practices establish a solid credit history, enhancing your overall creditworthiness. Daily routines like reviewing spending and setting aside savings contribute to financial discipline.

American financial education programs highlight the importance of these habits for long-term credit success. For example, setting up automatic payments ensures bills are paid on time, preventing late fees and negative marks. Consistency in these behaviors positions consumers favorably with lenders.

How does disputing errors help in the US?

Disputing errors on your credit report is a crucial step in maintaining an accurate credit score in the US. Consumers have the right to challenge inaccuracies by contacting credit bureaus and providing evidence of discrepancies. The bureaus then investigate claims within a set timeframe.

This process is vital for credit recovery, as even minor errors can cause significant score reductions. Knowing how to navigate disputes empowers consumers to protect their credit health. For instance, successfully disputing a falsely reported late payment can lead to an immediate score increase, underscoring the importance of vigilance.

What are the benefits of financial education resources?

Access to financial education, including workshops and online courses, enhances understanding of credit management. US programs offer free classes on budgeting, credit use, and financial planning, equipping consumers with knowledge to make informed decisions.

Participating in these resources improves credit management skills and credit scores. Below are notable American educational tools for credit enhancement:

- National Foundation for Credit Counseling (NFCC)

- Credit Counseling Services

- Consumer Financial Protection Bureau (CFPB) resources

- Local community workshops

Utilizing these programs fosters better financial habits and stronger credit profiles.

Common Mistakes to Avoid in the US

What errors do Americans often make with credit?

A frequent mistake is neglecting to regularly review credit reports, leading to unnoticed errors or negative items that harm scores. Proactive monitoring is essential to catch and correct issues early. Another common error is misunderstanding how credit scoring works, resulting in behaviors that unintentionally lower scores.

Education on credit management can help consumers avoid these pitfalls, ensuring they understand how actions like missed payments or high utilization affect their creditworthiness.

How should you handle high-interest debt wisely?

Managing high-interest debt in the US requires strategic planning and discipline. Avoid maxing out credit cards, as high balances can lower credit scores. Prioritizing payoff of high-interest debts first is an effective approach.

Here are US-specific debt management tactics:

- Prioritize payments on high-interest accounts

- Consider debt consolidation loans

- Set realistic repayment goals

- Communicate with creditors to negotiate terms

Applying these strategies helps preserve credit scores while reducing costly debt.

What are the risks of co-signing loans domestically?

Co-signing loans in the US carries risks because you assume responsibility if the primary borrower defaults. This can negatively impact your credit score if payments are missed. Your credit becomes tied to the borrower’s financial behavior.

Protect yourself by setting clear terms with the borrower and maintaining open communication about payments. Being proactive reduces potential damage to your credit from co-signing.

Why is identity theft protection important in the US?

Failing to monitor personal information exposes individuals to identity theft, which can severely damage credit scores and finances. Common mistakes include not using credit freezes or two-factor authentication. Regularly checking credit reports and using strong passwords mitigate these risks.

Identity theft insurance offers additional protection, safeguarding your credit score and financial future. Taking these precautions is critical in today’s digital environment.

What missteps do Americans make in retirement planning?

Many Americans delay retirement savings or fail to diversify investments, risking inadequate funds later in life. To avoid this, contribute regularly to accounts like 401(k)s or IRAs and understand tax benefits and employer matches.

US-specific strategies include adjusting for inflation and reviewing investments periodically. These steps secure financial futures while maintaining healthy credit profiles.

Maintaining Your Credit Over Time in America

How can you protect your score from fluctuations?

Protecting your credit score requires ongoing financial reviews and strategic management. Regularly assessing your financial health helps identify areas needing improvement, such as high credit utilization or missed payments. Using credit tracking tools provides insights into trends and behaviors that impact your score.

Consistent vigilance and proactive adjustments ensure your credit remains stable, supporting access to favorable personal and payday loans in Mississippi and across the US.

A Mississippi-based financial consultant with over a decade of experience in personal finance and payday lending. Originally from Jackson, he holds certifications in financial planning and credit advisory. Passionate about helping everyday Americans make smarter borrowing decisions, he focuses on guiding people away from common debt traps while promoting healthy financial habits. His expertise bridges the gap between short-term loan needs and long-term money management strategies. Outside of work, he volunteers with local programs that promote financial literacy across Mississippi.