Exploring the Economic Opportunities and Challenges in Mississippi

Mississippi is renowned for its rich cultural heritage and stunning natural landscapes, yet its economic landscape presents distinct challenges and opportunities that are important to understand. The state’s diverse economy, shaped by various key industries, necessitates a comprehensive approach for individuals seeking to establish financial stability. The relationship between economic trends and personal finance management is critical, as elements such as cost of living and job prospects can greatly influence financial strategies. Join us as we explore the intricate facets of Mississippi’s economic environment, equipping you with essential insights for achieving your financial aspirations.

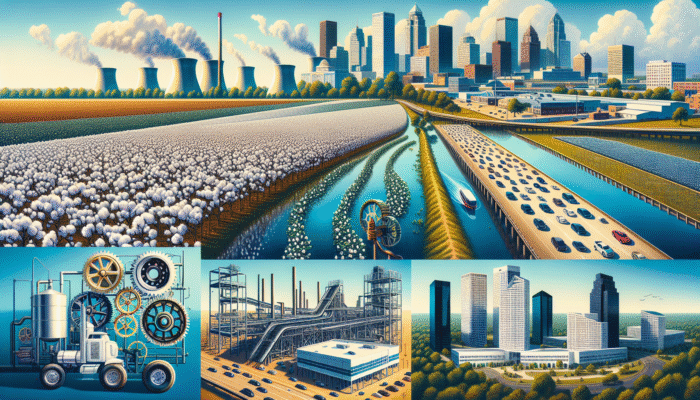

Identifying Mississippi’s Major Economic Contributors

Mississippi’s economy is bolstered by several vital industries that play a significant role in shaping its financial landscape. The agricultural sector is a cornerstone, positioning the state as a leading producer of catfish and cotton nationally. This sector not only fuels local economies but also generates numerous job opportunities, contributing positively to individual income levels. Additionally, the manufacturing industry is thriving, encompassing a wide range of sectors from automotive to furniture production, especially concentrated in regions like Tupelo. Furthermore, the healthcare sector is rapidly expanding, with hospitals and healthcare facilities growing to meet the increasing demand for quality services.

Grasping the dynamics of these industries is crucial for residents to optimize their budgeting strategies. For example, individuals employed in agriculture may experience income fluctuations throughout the year, requiring a budget that can accommodate these seasonal changes. In contrast, those in stable manufacturing roles might find their earnings more predictable, influencing their saving and investment tactics accordingly.

Moreover, the tourism industry in Mississippi, featuring attractions such as the Natchez Trace Parkway, plays a vital role in the state’s economy by generating revenue that circulates within local communities. Recognizing the importance of these industries enables you to adjust your financial plans to align with the job stability and income opportunities specific to your region.

Understanding the Variability of Living Costs

The cost of living is a crucial factor in learning how to create a budget for financial stability in Mississippi. While the state generally offers a lower cost of living compared to the national average, significant disparities exist between urban and rural areas. For instance, cities such as Jackson and Hattiesburg may present higher housing costs than smaller towns like Vicksburg or Corinth.

When planning your budget, it is imperative to take these cost variations into account. Living in a city with a higher cost of living may necessitate allocating a larger share of your budget to housing and utility expenses. Conversely, residing in a rural area could afford you lower living costs, thus allowing more flexibility in your discretionary spending, such as savings or leisure activities.

Transportation costs also vary significantly. In regions lacking extensive public transport options, owning a vehicle becomes essential, thereby increasing overall living expenses. By incorporating these factors into your budget, you ensure a realistic financial plan tailored to your location and lifestyle needs.

Recognizing Economic Trends That Affect Personal Budgets

Economic trends, including employment rates, inflation, and interest rates, have profound effects on personal budgets throughout Mississippi. Recent fluctuations in the job market have influenced income levels and employment security. Staying updated on local economic indicators is vital for anticipating changes that could impact your financial well-being.

Inflation, while a national concern, can manifest in unique ways within Mississippi. For example, rising prices of everyday goods can diminish purchasing power, making it essential to adjust your financial strategies accordingly. Monitoring shifts in housing costs, utility expenses, and food prices can provide critical insights into your future budgeting requirements.

Additionally, the increasing prevalence of remote work has transformed the economic landscape, enabling residents to pursue job opportunities beyond state boundaries, which potentially enhances their income prospects. However, this shift often necessitates a reevaluation of budget priorities, especially if relocating for employment becomes a viable option.

By understanding these economic trends, Mississippi residents can proactively position themselves to make informed budgeting decisions that foster long-term financial stability.

Establishing Clear Financial Goals for Success

Setting specific financial goals is fundamental to any effective budgeting strategy. Whether your aspirations include eliminating debt, saving for a home, or preparing for retirement, defining these objectives offers clarity and purpose to your financial planning efforts. In Mississippi, where economic conditions can vary greatly, developing personalized financial goals is critical for achieving financial stability.

Focusing on Short-Term Financial Goals

Short-term financial goals are essential for laying a strong foundation for your future. Many residents in Mississippi may prioritize building an emergency fund, particularly considering the state’s vulnerability to natural disasters such as hurricanes and floods. Establishing a savings cushion not only provides peace of mind but also helps prevent debt accumulation during unforeseen events.

Additionally, prioritizing the repayment of smaller debts, such as credit card balances or personal loans, should be a key focus. Implementing techniques like the snowball method, where you pay off the smallest debts first, can create momentum and motivate you to address larger financial commitments.

Another common short-term goal might involve saving for specific occasions, like a family vacation or holiday festivities. By consistently allocating a portion of your budget each month toward these goals, you can avoid financial stress when it’s time to enjoy these experiences.

Strategic Long-Term Financial Planning

In Mississippi, long-term financial planning is crucial for achieving significant life milestones, such as purchasing a home or preparing for retirement. Understanding the local real estate market is vital for successfully navigating the home-buying process. You will need to consider various costs, including property taxes, homeowners’ insurance, and potential maintenance expenses, which can vary dramatically between urban and rural areas.

Planning for retirement is another fundamental aspect of long-term financial strategy. While many residents may depend on Social Security, it’s crucial to supplement this income through personal savings. Opening a retirement account, such as an IRA or 401(k), can offer tax advantages and harness the power of compound interest over time.

Evaluating your risk tolerance when investing is another key component of long-term planning. Whether you are considering real estate or stocks, understanding your comfort level with different investment vehicles allows you to construct a diversified portfolio aligned with your financial objectives.

Adapting Financial Goals to Life Changes

Life transitions—such as starting a family, changing jobs, or pursuing further education—often necessitate adjustments to your financial goals. In Mississippi, where family values are significant, many residents must balance personal and financial responsibilities, which requires flexibility.

For example, welcoming a new child into your family may require a thorough reevaluation of your budget to account for expenses related to childcare and education savings. Similarly, a job change may alter your income and benefits, prompting a reassessment of your savings and investment strategies.

It’s important to remember that financial goals should be adaptable. Regularly reviewing and modifying them based on your life circumstances will help ensure that you stay on track toward achieving your overarching financial stability. Scheduling periodic financial check-ins—perhaps every six months—can assist you in aligning your evolving goals and aspirations.

Developing a Practical Budget for Financial Success

Creating a practical budget is essential for attaining financial stability in Mississippi. A budget acts as a financial roadmap, directing your spending, saving, and investing decisions. By evaluating your income and expenses, you can allocate resources more effectively to meet your financial objectives.

Comprehensive Income Assessment in Mississippi

The initial step in constructing your budget involves a thorough evaluation of your income. Common income sources in Mississippi include wages from employment, government assistance programs, and income from side businesses. It is essential to account for all income streams to gain a clear understanding of your financial situation, which will enable you to decide how much you can allocate toward expenses and savings.

Particularly in sectors like agriculture, where seasonal fluctuations can impact earnings, it is crucial to consider income variability. If you are self-employed or on commission, you should average the income from previous years to ensure that your budget reflects realistic expectations.

Also, be aware of available benefits for Mississippians—such as SNAP for food assistance or Medicaid for healthcare coverage—which can positively enhance your overall income profile. This thorough assessment will provide the foundation for a realistic and efficient budget tailored to your distinctive circumstances.

Tracking and Categorizing Expenses Effectively

After assessing your income, the next step is to track and categorize your expenses. This process is crucial for understanding where your money is allocated and for identifying potential savings opportunities. Begin by gathering your bank statements and receipts for a month to gain a comprehensive view of your spending habits.

In Mississippi, common categories of expenses include housing, transportation, food, healthcare, and entertainment. Housing costs can vary dramatically based on location, so be sure to include mortgage or rent payments, property taxes, insurance, and maintenance expenses.

Tracking utility bills is equally important, as rising energy costs can significantly affect your monthly budget. Mississippi frequently experiences fluctuations in energy prices, so exploring opportunities for savings, such as investing in energy-efficient appliances, can help lower overall expenses.

Categorizing your spending not only aids in pinpointing wasteful habits but also allows you to prioritize your financial goals. By setting limits on discretionary spending, such as dining out or entertainment, you can redirect those funds toward savings or debt repayment.

Utilizing Budgeting Tools and Applications

In today’s technology-driven world, utilizing budgeting tools and applications can streamline your financial management processes, making it easier to stay on track. Popular budgeting apps like Mint and YNAB (You Need a Budget) allow you to connect your bank accounts, monitor expenses in real-time, and set financial goals.

Additionally, you can explore local resources, such as community financial literacy workshops or tools offered by Mississippi-based credit unions, which often provide personalized assistance in budgeting and financial planning.

By leveraging these tools, you can automate aspects of your budgeting process, allowing you to concentrate on what truly matters—achieving financial stability. Whether through mobile applications or community support, embracing technology can significantly enhance your budgeting experience.

Strategies for Managing Debt and Building Savings

Effectively managing debt and cultivating savings are critical elements of maintaining financial stability in Mississippi. Many residents encounter unique challenges regarding debt, making it essential to adopt robust strategies that facilitate financial freedom while simultaneously building a secure future.

Effective Strategies for Debt Reduction

Debt can often feel overwhelming, but Mississippi residents have access to several effective strategies for managing debt. One popular method is the snowball method, which focuses on paying off the smallest debts first. By eliminating these smaller debts, you can build momentum and motivation to tackle larger financial obligations.

Alternatively, the avalanche method targets debts with the highest interest rates first, potentially saving you more money in the long run. Both approaches necessitate disciplined budgeting and consistent payments, yet they can pave the way for a quicker path to financial freedom.

Additionally, residents may find it beneficial to explore credit counseling services available in Mississippi. These organizations can offer tailored advice and support for individuals struggling with debt, often providing financial education workshops to empower you with the knowledge needed to manage your finances effectively.

By adopting a strategic approach to debt reduction, you can regain your financial freedom and redirect funds toward savings and investment opportunities.

Establishing a Robust Emergency Fund

An emergency fund is a fundamental component of financial health, serving as a safety net against unforeseen expenses. In Mississippi, where natural disasters can occur, the significance of having savings set aside is paramount. Aim to save three to six months’ worth of living expenses in a dedicated account to ensure that you can cover costs during emergencies.

Begin by setting a modest goal, such as saving $1,000 initially, and gradually build from there. Automating your savings can simplify the process; consider setting up a direct transfer of a portion of your income into your savings account each month.

Given that many Mississippians may encounter unexpected medical expenses, having an emergency fund can alleviate the financial strain associated with health-related issues. By prioritizing emergency savings, you establish a buffer that fosters peace of mind and allows you to manage life’s uncertainties without resorting to debt.

Investing and Saving for Long-Term Financial Growth

Investing serves as a powerful method for growing your wealth over time, and residents of Mississippi have a variety of options at their disposal. Consider opening a retirement account, such as a 401(k) or IRA, to capitalize on tax benefits while saving for your future. Many employers in Mississippi offer matching contributions, so maximizing these benefits can significantly enhance your retirement savings.

Investigate local investment opportunities, such as real estate or stocks, to diversify your portfolio. Researching Mississippi-based businesses for investment can not only support your community but also yield potential financial returns.

Additionally, if you have children, consider education savings accounts. Mississippi provides options like the Mississippi Affordable College Savings Plan (MACS), which can help you save for future education expenses while enjoying tax advantages.

By adopting a proactive investment strategy, you can secure a stable financial future while ensuring your savings continue to flourish.

Techniques for Effective Credit Management

Managing your credit effectively is vital for achieving financial stability in Mississippi. A favorable credit score can unlock better interest rates on loans, mortgages, and credit cards, ultimately saving you money over time. Start by regularly checking your credit report for inaccuracies, as errors can negatively impact your score.

If your credit score is lower than desired, there are strategies you can implement to enhance it. Make timely payments, as your payment history is a significant factor affecting your credit score. Additionally, reducing your credit utilization ratio—keeping it below 30%—can also positively influence your score.

Furthermore, consider joining credit counseling programs available in Mississippi, which can educate you on maintaining good credit. These programs provide valuable insights into managing credit and debt effectively.

By actively managing your credit, you not only improve your borrowing potential but also lay a solid foundation for your financial future.

Strategizing Retirement Planning in Mississippi

Planning for retirement is a vital element in achieving financial stability in Mississippi. Start by determining your retirement objectives—what age do you wish to retire? What lifestyle do you envision? Clarifying these factors will guide your savings strategy.

Utilizing employer-sponsored retirement plans, such as 401(k)s, which often come with matching contributions, can significantly boost your savings. This is effectively free money, so prioritize contributing at least up to the match if feasible. Moreover, consider establishing an Individual Retirement Account (IRA), which offers tax advantages as you save.

Regularly review your retirement savings progress. Utilize retirement calculators to estimate how much you need to save monthly to achieve your goals. Adjust your contributions as necessary based on changes in income or expenses.

Finally, contemplate consulting a financial advisor who is knowledgeable about the Mississippi economic landscape. They can offer tailored advice on investment strategies and retirement planning, ensuring that you’re on course to retire comfortably.

Navigating the Complexities of Mississippi’s Tax System

A comprehensive understanding of Mississippi’s tax system is essential for effective budgeting and optimizing your financial resources. From state taxes to local fees, being aware of your tax obligations will enable you to plan your finances with greater accuracy and efficiency.

Comprehending State Tax Regulations

Mississippi’s state income tax operates on a graduated scale, with rates ranging from 0% to 5%. Understanding where you fall within this scale will help you estimate your tax liability and its repercussions on your budget. Additionally, property taxes can vary significantly based on your home’s location, making it crucial to grasp these rates for accurate budgeting.

Sales tax is another important consideration. Mississippi imposes a state sales tax rate of 7%, but local jurisdictions may impose additional taxes, so it’s imperative to account for this when making purchases. Keeping track of these taxes will provide a clearer picture of your overall expenses.

By staying informed about Mississippi’s tax structure, you can make more strategic spending and saving decisions, ensuring your budget reflects your actual financial obligations.

Understanding Local Taxes and Fees

Local taxes and fees can significantly influence household budgets in Mississippi. In addition to state taxes, residents must be aware of city or county-specific taxes that may apply. For instance, certain municipalities may impose local sales tax rates that exceed the state rate.

Various service-related fees, such as those for waste management or public utilities, can also accumulate. Being mindful of these local costs allows you to incorporate them accurately into your budget.

Staying informed about local tax assessments and potential changes is essential for long-term budgeting. Attend community meetings or visit local government websites to stay updated on any tax changes that could impact your financial situation.

Effective Tax Planning and Potential Savings

Proactive tax planning can result in significant savings when approached correctly. In Mississippi, consider contributing to tax-advantaged accounts, such as IRAs or health savings accounts (HSAs). These accounts provide tax benefits while helping you save for specific future expenses.

It’s also crucial to maintain meticulous records of your deductions, as Mississippi residents may qualify for various state tax credits. Familiarizing yourself with available credits, such as those for education and energy efficiency upgrades, can help maximize your potential savings.

Consulting a tax professional familiar with Mississippi’s specific tax regulations can also yield insights into effective tax strategies that enhance your overall financial plan.

Understanding the Tax Filing Process in Mississippi

Filing taxes in Mississippi requires familiarity with the necessary steps and deadlines. Typically, state tax returns are due on April 15, aligning with federal filing deadlines. Ensure that you gather all necessary documentation, including W-2s, 1099s, and other income statements before preparing your return.

Mississippi allows for electronic filing, which can simplify the process and expedite your refund. Utilize the resources from the Mississippi Department of Revenue to access e-filing options and information on required forms.

Familiarizing yourself with Mississippi’s tax rules can help prevent costly mistakes and facilitate a smoother filing experience. By being proactive in your tax preparation, you can minimize stress and maximize your financial returns.

Identifying Tax Credits and Deductions

Mississippi provides several tax credits and deductions that can help reduce your overall tax liability. Common credits include those for childcare expenses, education-related costs, and even for purchasing energy-efficient appliances. Taking advantage of these opportunities can significantly enhance your financial situation.

Be sure to thoroughly research and understand the eligibility criteria for available credits. For example, the Mississippi Education & Property Tax Credit allows qualifying residents to receive a credit on their property taxes, making homeownership more accessible.

Consulting with a tax professional can offer valuable insights into maximizing credits and deductions, tailored to your specific financial situation. By leveraging these opportunities, you can create a more effective budget that accounts for potential tax savings.

Strategizing Healthcare and Insurance Expenses

Healthcare costs can substantially affect your budget, making effective planning crucial for achieving financial stability in Mississippi. Understanding the available insurance options and budgeting for healthcare expenses can help you maintain financial health while addressing medical needs.

Exploring Health Insurance Options in Mississippi

Mississippi residents have access to a variety of health insurance options, ranging from employer-sponsored plans to individual policies. The Affordable Care Act provides a marketplace for residents to explore options that accommodate their needs and financial situations.

When selecting a health insurance plan, consider critical factors like premiums, deductibles, and out-of-pocket costs. Assessing your health needs, including any chronic conditions, is essential for choosing a plan that offers adequate coverage without straining your finances.

Moreover, many Mississippi residents may qualify for Medicaid, providing low-income individuals and families with essential health coverage. Understanding the eligibility and application processes can help you access necessary healthcare services while minimizing costs.

Budgeting for Healthcare Expenses Strategically

Budgeting for healthcare expenses requires a proactive approach, as costs can vary widely based on your insurance plan and medical requirements. Create a dedicated budget category for healthcare, accounting for premiums, copays, and prescription costs.

Additionally, factor in potential out-of-pocket costs that may arise from unexpected medical visits or treatments. By allocating funds for these expenses, you can avoid financial surprises that disrupt your overall budget.

Researching local healthcare providers can also help manage costs. Many Mississippi residents discover that comparing prices for procedures and services can lead to substantial savings. By planning ahead, you will be better prepared to handle your healthcare expenses without compromising your financial goals.

Preparing for Long-Term Care Costs

Long-term care planning is an often-neglected aspect of healthcare budgeting. As individuals age, the likelihood of needing long-term care services—such as nursing homes or in-home assistance—becomes increasingly relevant.

Mississippi offers various long-term care options, but understanding the associated costs is vital. Explore insurance options that cover long-term care, as this can help protect your finances from the burden of unexpected healthcare expenses in later years.

Additionally, consider setting aside specific funds in your budget dedicated to long-term care. Establishing a separate savings account for this purpose can provide peace of mind and ensure you’re prepared for the future.

By proactively planning for long-term care needs, Mississippi residents can better navigate potential healthcare challenges and maintain financial stability throughout their lives.

Education Funding and Family Budgeting Strategies

For families in Mississippi, budgeting for education and family-related expenses is essential for achieving financial stability. Understanding the costs associated with education, childcare, and family needs enables more strategic financial planning.

Prioritizing Education Savings in Mississippi

Education savings should be a top priority for Mississippi families. Consider establishing a 529 college savings plan, which offers tax-free growth and withdrawals for qualified educational expenses. These plans can significantly ease the financial burden of higher education, especially as college costs continue to rise.

Additionally, research scholarships and grants available specifically for Mississippi residents. Numerous organizations and institutions offer funding opportunities for students, helping to offset tuition and related expenses.

Encourage your children to apply for scholarships early, as many have specific eligibility requirements and deadlines. By proactively saving and leveraging available resources, you can better prepare for your children’s educational futures.

Budgeting for Family Expenses Efficiently

Family-related expenditures can accumulate rapidly, making it essential to incorporate them into your budget. Start by identifying common expenses—such as groceries, clothing, and entertainment—and establish realistic spending limits for each category.

In Mississippi, families often enjoy recreational activities that entail moderate costs, such as local festivals or outdoor events. Planning for these activities can enhance family bonding while ensuring you adhere to your budget.

Additionally, if you have young children, consider childcare costs. Research local options, including daycare centers or after-school programs, to find affordable solutions that align with your budget. Allocating funds specifically for these expenses can help you avoid overspending.

By proactively budgeting for family needs, you can create a stable financial environment that supports both your immediate and long-term goals.

Managing Childcare and After-School Expenses

Childcare and after-school programs represent substantial expenses for many families in Mississippi. When budgeting for these costs, consider the diverse options available. Local daycare centers, in-home care, and after-school programs can vary significantly in price.

Researching local providers can assist you in finding options that fit your budget while meeting your children’s needs. Establishing a budget category specifically for childcare and after-school expenses will enable you to allocate adequate funds for these essential services.

Furthermore, consider discussing flexible work arrangements with your employer, which might help reduce childcare costs by allowing you to modify your schedule. By being strategic about your childcare expenses, you can ensure that you meet your family’s needs without sacrificing your financial stability.

Frequently Asked Questions

What is the first step to creating a budget in Mississippi?

The first step is to assess your income and expenses. Calculate your total income from all sources, then track your monthly expenses to identify spending patterns.

What are common budgeting tools for Mississippi residents?

Popular budgeting tools include apps like Mint and YNAB, which help track income and expenses. Local credit unions may also offer financial planning resources.

How much should I save for emergencies?

Aim to save three to six months’ worth of living expenses in an emergency fund to cover unexpected costs such as medical emergencies or job loss.

What financial goals should I focus on first?

Start with short-term goals, such as building an emergency fund and paying off small debts, before expanding to long-term objectives like retirement savings.

Are there state-specific tax credits available in Mississippi?

Yes, Mississippi offers various tax credits, including credits for childcare expenses and education-related costs, which can help reduce tax liability.

What should I include in my healthcare budget?

Budget for health insurance premiums, copays, prescriptions, and potential out-of-pocket expenses to ensure you’re prepared for healthcare costs.

How do I improve my credit score in Mississippi?

Pay bills on time, reduce credit card balances, and regularly check your credit report for inaccuracies to enhance your credit score.

What retirement plans are available for Mississippi residents?

Residents can utilize employer-sponsored retirement accounts like 401(k)s and individual retirement accounts (IRAs) to save for retirement.

Is it beneficial to consult a financial planner?

Yes, a financial planner can provide personalized advice tailored to your financial situation and goals, helping you create a comprehensive budget.

How can I save for my children’s education in Mississippi?

Consider setting up a 529 college savings plan and researching scholarships available for Mississippi residents to help save for education costs.

See also: Finance & Business.

See also: Starkville, MS.

A Mississippi-based financial consultant with over a decade of experience in personal finance and payday lending. Originally from Jackson, he holds certifications in financial planning and credit advisory. Passionate about helping everyday Americans make smarter borrowing decisions, he focuses on guiding people away from common debt traps while promoting healthy financial habits. His expertise bridges the gap between short-term loan needs and long-term money management strategies. Outside of work, he volunteers with local programs that promote financial literacy across Mississippi.

It’s interesting to see how Mississippi’s rich cultural heritage intersects with its economic landscape. Growing up there, I’ve seen firsthand how industries like agriculture not only sustain families but also preserve traditions and community ties. But it’s also clear that we face significant challenges, especially with the cost of living and job market fluctuations.

It’s great to hear your perspective, especially since you’ve experienced the nuances of life in Mississippi firsthand. You’re right about the critical role agriculture plays—not just in terms of economics, but also in maintaining those deep-rooted traditions and fostering community connections.

It’s true; Mississippi’s cultural heritage is woven deeply into its economic backbone. The way agriculture plays a role in both sustaining families and preserving traditions is something that seems unique to the area. I remember visiting local farmers’ markets where you can see generations of families sharing their produce, recipes, and stories. Those connections give the community a sense of continuity amidst change.

What a fascinating dive into Mississippi’s economic landscape! It’s like peeling an onion – so many layers and sometimes it even makes you cry a little (especially at the gas pump). I appreciate the nod to agriculture, which seems like it’s practically the state’s unofficial mascot. I mean, can we talk about the cornbread? If Mississippi’s economy could cook, it would definitely whip up a batch of something deliciously corn-based!

It’s great to see you connecting with the layers of Mississippi’s economy! The analogy of peeling an onion really resonates; there’s so much going on below the surface, and sometimes it can feel overwhelming. But you’re right—agriculture is at the heart of it all. It’s remarkable how it shapes not just our economy, but also our culture and way of life.

I appreciate your reflections on the complexity of Mississippi’s economy. The analogy of peeling an onion really does capture the essence of getting to know the intricacies involved. Agriculture being at the heart of it all makes perfect sense when you consider how deeply interwoven it is with our cultural identity. I often think about how local farms serve not just as providers of food, but also as community hubs. They help maintain traditions through food festivals, farmer’s markets, and the sharing of knowledge among generations.

Your exploration of Mississippi’s economic landscape really resonates, especially the connection between economic trends and personal finance. It’s interesting to think about how the agricultural sector, for instance, not only shapes the state’s economy but also impacts the livelihoods of families across the region. My family has been involved in farming for generations, and I’ve seen firsthand how fluctuations in market prices and weather can alter financial stability dramatically.

Your insights into Mississippi’s economic landscape resonated with me, especially regarding the importance of addressing both opportunities and challenges. I’ve always admired the state’s agricultural heritage, which truly showcases the resilience and resourcefulness of its people. It’s fascinating how intertwined the farming sector is with modern economic strategies, particularly as trends shift towards sustainable practices and the growing demand for local produce.

It’s great to hear you connected with the piece! Mississippi’s agricultural backbone is like that trusty ol’ tractor—grimy but essential and still chugging along despite a few bumps in the road. You hit the nail on the head about the mix of tradition and innovation; it’s a dance where farmers are putting on their best boots and also zooming in on apps for crop management.

I’m glad the article struck a chord with you. Mississippi’s agricultural roots really do paint a vivid picture of the state’s character—so much history woven into those fields, right? It’s interesting to see how farmers are adapting, especially with more folks hungry for local, sustainable options.

Reading your exploration of Mississippi’s economic landscape truly resonated with me, particularly the emphasis on how intertwined personal finance management is with the broader economic trends in the state. As someone who has lived in Mississippi for several years, I’ve witnessed firsthand the unique challenges we face, especially in rural areas where opportunities can seem limited. Yet, the potential for growth is equally palpable!

It’s interesting how our personal finance management really does reflect those broader economic trends, isn’t it? In Mississippi, I think the contrast between urban and rural areas can be striking. While cities like Jackson and Hattiesburg show some promise with new businesses and initiatives, rural areas often seem to be left behind.

I appreciate how you captured the essence of Mississippi’s economic landscape—it really is a complex tapestry. Living in rural areas, as you mentioned, provides a unique perspective on both the challenges and opportunities that come with it. I’ve often thought about how personal finance management can be both a tool for individual empowerment and a reflection of those broader economic trends.

I found some valuable insights on managing payday loan fees in Mississippi that really reflect our shared experiences and challenges here, especially for those of us in rural areas.

‘Reducing Payday Loan Fees in Mississippi: Essential Tips’

https://kopitiamekonomi.com/reducing-payday-loan-fees-in-mississippi-essential-tips/.

I completely understand where you’re coming from. The complexities of personal finance in Mississippi really do reflect the state’s broader economic challenges, especially in those rural areas. It’s interesting to see how even small decisions can have a ripple effect on the local economy.

When it comes to Mississippi, the rich tapestry of culture and natural beauty is just the cherry on top of a rather complex economic pie. Having spent some time bouncing around the state—not to mention frequenting its famous barbecue joints—I’ve come to appreciate both the challenges and opportunities that make Mississippi’s economy as quirky as it is intriguing.