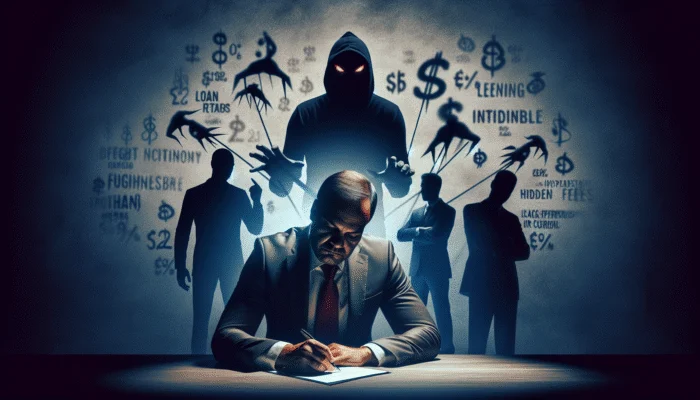

Comprehending the Dangers of Predatory Lending Practices

Predatory lending represents a harmful financial practice that predominantly preys on vulnerable populations, often pushing them into an unending cycle of debt. To safeguard yourself and others in Mississippi from becoming victims of predatory payday lenders, it’s essential to thoroughly understand the mechanisms of these practices. By familiarizing yourself with the definition, common tactics, warning signs, impacts, and the legal protections available against predatory lending, you can equip yourself with the necessary knowledge to navigate the financial landscape with confidence and security.

What Constitutes Predatory Lending?

Predatory lending consists of a spectrum of unfair, deceptive, or fraudulent practices that exploit borrowers, particularly those in difficult financial situations. These loans are characterized by exorbitant interest rates, hidden fees, and terms that borrowers find nearly impossible to fulfill. The predatory nature of these loans often targets individuals who lack access to traditional banking options, such as low-income earners or those with poor credit histories. This exploitation can manifest in various forms, including payday loans, title loans, and other short-term credit options that promise quick cash but ultimately lead to long-term financial hardship.

Grasping the definition of predatory lending is the foundational step in protecting yourself against it. In Mississippi, the payday lending sector has flourished under lax regulations, rendering it a hotspot for these predatory practices. The enticing promise of quick cash can blind borrowers to the long-term consequences, trapping them in a debt cycle that necessitates continual borrowing to repay previous loans. This relentless cycle is a defining feature of predatory lending, and recognizing it is crucial for avoiding such financial traps.

Deceptive Tactics Employed by Predatory Lenders

Predatory lenders utilize a variety of tactics specifically designed to ensnare unsuspecting borrowers. One prevalent tactic is the imposition of exorbitant fees that can escalate rapidly. For example, a payday loan may advertise a seemingly low interest rate, yet the effective annual percentage rate (APR) can skyrocket into triple digits once all fees are factored in. This confusing structure can mislead borrowers into believing they are securing a favorable deal.

Another common tactic involves hidden charges that are often cleverly concealed within the fine print. Borrowers may find themselves shocked by unexpected fees, such as penalties for late payments or additional costs for extending the loan period. These deceptive tactics are deliberately designed to obscure the true cost of borrowing, making it nearly impossible for borrowers to fully comprehend the financial implications of their loans.

Misleading terms are also a hallmark of predatory lending. Lenders might advertise enticing offers like “no credit check” or “guaranteed approval,” preying on individuals who are in desperate need of funds. While these terms may appear attractive at a glance, they often come with clauses that significantly disadvantage the borrower. Understanding these tactics can empower you to identify when an offer is too good to be true, enabling you to avoid predatory lenders.

Identifying Warning Signs of Predatory Lending

Recognizing the warning signs associated with predatory lending can be the vital difference between achieving financial security and facing ruin. One of the most conspicuous indicators is the use of aggressive sales tactics by lenders. If a lender pressures you to sign quickly without giving you sufficient time to read the fine print or comprehend the terms, that’s a major red flag. A reputable lender will encourage you to take your time, ensuring you fully grasp the implications of your borrowing.

A lack of transparency is another significant red flag. If a lender is unwilling to provide clear answers to your inquiries regarding fees, interest rates, or repayment terms, it’s crucial to proceed with caution. Transparency is a cornerstone of any legitimate financial transaction, and a trustworthy lender will be forthright about all loan aspects.

Finally, be wary of loans that appear too good to be true. Offers that guarantee instant approval, no credit checks, or unreasonably low interest rates often come with hidden pitfalls. Borrowers must be diligent in scrutinizing the offers and should always seek further information before making any commitments.

The Detrimental Impact of Predatory Lending on Borrowers

The consequences of predatory lending for borrowers can be devastating. Many individuals find themselves trapped in a relentless cycle of debt that is incredibly challenging to escape. High interest rates and additional fees can compel borrowers to take out multiple loans just to cover existing debts, exacerbating their financial troubles. As a result, many end up with severely damaged credit scores, which can hinder their ability to secure any form of credit in the future.

Moreover, the emotional and psychological ramifications of predatory lending should not be underestimated. Borrowers frequently experience intense stress, anxiety, and feelings of helplessness as they grapple with repaying loans that seem to multiply rather than diminish. This financial strain can lead to broader life challenges, affecting job stability, personal relationships, and overall well-being.

In Mississippi, the repercussions can be particularly severe due to the absence of stringent regulations governing payday lending. Many borrowers may lose vital assets, such as vehicles or homes, while trying to manage their debts. Understanding these impacts is essential for recognizing the importance of steering clear of predatory payday lenders, empowering individuals to take proactive measures to protect their financial futures.

Available Legal Protections Against Predatory Lending Practices

Fortunately, there are various legal protections in place designed to shield borrowers from predatory lending practices. The Truth in Lending Act (TILA) is a federal law aimed at promoting transparency in lending. It mandates that lenders disclose key terms and costs associated with loans, allowing borrowers to make informed financial decisions. Understanding your rights under TILA can help you identify potentially predatory practices before they inflict harm.

In addition to federal laws, Mississippi has specific regulations governing payday lending. These regulations include limits on the maximum fees and interest rates that lenders can impose. Familiarizing yourself with these state-specific rules can provide essential leverage when dealing with payday lenders, ensuring that borrowers are not subjected to illicit practices.

If you suspect that you have become a victim of predatory lending, it’s important to know how to file a complaint. Both state and federal agencies, including the Consumer Financial Protection Bureau (CFPB) and the Mississippi Attorney General’s Office, allow individuals to report unfair lending practices. Taking action not only aids you but also contributes to larger efforts aimed at holding predatory lenders accountable.

Conducting Thorough Research on Lenders Before Borrowing

Before entering into any loan agreement, it is vital to conduct thorough research on potential lenders. The importance of due diligence cannot be overstated, as it can determine whether you secure reliable financing or fall victim to the traps set by predatory payday lenders. A well-informed borrower is significantly less likely to make hasty decisions that could lead to substantial financial repercussions.

The Critical Role of Due Diligence in Financial Decisions

Performing due diligence when researching lenders is your primary defense against predatory lending practices. This process involves evaluating a lender’s reputation, terms, and practices to ensure they align with your financial needs and ethical standards. The sooner you can identify problematic lenders, the better positioned you will be to choose a responsible financial path.

An effective strategy is to seek out lenders that are well-established and have garnered positive reviews from previous customers. Reputable lenders tend to have a track record of transparent practices, fair fees, and a commitment to customer service. Engaging with community resources and financial education programs can also provide valuable insights into trustworthy lending options and help you avoid predatory lenders.

Additionally, assess the lender’s website and available documentation. A legitimate lender will provide clear information regarding terms, conditions, and fees. If this information is difficult to locate or is presented in a confusing manner, it may serve as a warning sign indicating potential unethical practices. Taking the time to conduct thorough due diligence empowers you to make informed decisions, thereby reducing the risk of falling prey to predatory lenders.

Verifying Lender Credentials for Security

It is crucial to verify a lender’s credentials to ensure they operate legally and ethically. In Mississippi, all lenders are required to be licensed and regulated by state authorities. You can check their licensing status through state resources or websites dedicated to consumer protection. This verification step is essential to safeguard against unlicensed lenders who may engage in predatory practices.

Reputable lenders typically display their licensing information prominently on their websites. If you cannot locate this information, or if a lender is reluctant to provide it, consider this a red flag. Engaging only with licensed lenders ensures that they comply with state regulations, offering a level of security and accountability in your borrowing experience.

Moreover, it may be beneficial to consult local consumer protection agencies, such as the Better Business Bureau (BBB). These organizations often compile reports on lenders’ practices, including any complaints or legal actions taken against them. Researching this information can help you gain a clearer understanding of a lender’s reliability and ethical standing.

Evaluating Customer Reviews and Testimonials

Customer reviews and testimonials offer invaluable insights into a lender’s reputation and the experiences reported by other borrowers. Reading reviews allows potential borrowers to assess the quality of service, transparency, and overall satisfaction expressed by previous clients. Look for reviews on multiple platforms, including social media, dedicated review websites, and consumer advocacy forums.

When examining reviews, pay attention to patterns that reveal consistent experiences, whether positive or negative. If numerous reviewers highlight similar issues, such as exorbitant fees, lack of transparency, or poor customer service, it may be prudent to steer clear of that lender. Conversely, positive reviews that commend a lender for their ethical practices and fair terms can signal a trustworthy option.

Additionally, it is vital to verify the authenticity of reviews. Exercise caution regarding fake testimonials, which can sometimes be fabricated to mislead potential borrowers. Seek out detailed accounts that provide real-life experiences rather than generic commendations. By thoroughly researching reviews and testimonials, you can make a more informed decision and effectively avoid predatory lenders.

Exploring Viable Alternatives to Payday Loans

When confronted with a financial crisis, payday loans may appear to be an attractive option; however, there are several viable alternatives that can help you evade the pitfalls of predatory lending. By exploring these alternatives, you can discover solutions that better address your financial needs without incurring the high costs associated with payday loans.

Exploring Credit Union Loans as an Alternative

Credit unions present a compelling alternative to payday loans, frequently offering lower interest rates and more flexible terms. Unlike traditional banks, credit unions are non-profit organizations owned by their members, which empowers them to provide more favorable loan conditions. Many credit unions offer small personal loans or short-term loans specifically designed to assist members in managing unexpected expenses.

Applying for a loan through a credit union is generally a straightforward process. Since credit unions aim to support their members, they often provide personalized service and may even work with borrowers who have less-than-stellar credit histories. Additionally, credit unions tend to be more transparent in their lending practices, making it easier for borrowers to comprehend the terms and conditions of their loans.

Members of credit unions may also gain access to valuable financial education resources, empowering them to make informed borrowing decisions in the future. By opting for a credit union for your lending needs, you can access fair financial products while steering clear of the predatory practices often associated with payday lenders.

Considering Personal Loans from Banks

Traditional banks can also serve as a source for personal loans as an alternative to payday lending. Although the application process may be more rigorous than that of payday lenders, banks typically offer lower interest rates and superior repayment terms. Personal loans from banks can be utilized for various purposes, including consolidating debt, covering unforeseen expenses, or financing significant purchases.

When contemplating a personal loan from a bank, it’s essential to shop around and compare different offers. Each bank may present varying terms, fees, and interest rates, so investing the time to research can lead to considerable savings. Additionally, some banks may offer special programs designed for customers with lower incomes or poor credit, making it easier for you to qualify.

Securing a personal loan from a bank can empower you to manage your financial needs without resorting to predatory payday loans. The stability and reliability of traditional banking institutions provide borrowers with a sense of security, ensuring they are making sound financial decisions.

Borrowing from Friends or Family: A Supportive Option

Borrowing from friends or family can be an affordable and supportive alternative to payday loans. Unlike formal lending options, borrowing from loved ones often comes without interest or fees, significantly alleviating the financial burden. This option can be particularly advantageous during times of crisis, as personal connections often foster understanding and flexibility regarding repayment terms.

However, it’s crucial to approach this option with caution and maintain clear communication. Discuss the terms of the loan openly to prevent misunderstandings or strained relationships. Establishing a repayment schedule can help both parties feel at ease and maintain the integrity of the relationship.

While borrowing from loved ones may not be suitable for everyone, it can serve as a lifeline for those facing financial challenges. By exploring this alternative, you can often avoid the risks associated with predatory payday lenders, fostering a sense of community and support during tough times.

Understanding Your Rights as a Borrower in the Financial Landscape

As a borrower, it is vital to understand your rights to effectively protect yourself from predatory lending practices. Familiarizing yourself with federal protections and state-specific regulations can empower you to make informed decisions and seek recourse if you find yourself in a vulnerable position.

Federal Protections: Safeguarding Consumer Rights

Federal laws, such as the Truth in Lending Act (TILA), exist to shield consumers from predatory lending practices. TILA mandates that lenders disclose crucial information about loans, including interest rates, fees, and repayment terms, ensuring that borrowers have the necessary information to make informed decisions. Familiarity with your rights under TILA is essential, as it helps you identify when a lender is operating outside the legal framework.

Additionally, the Consumer Financial Protection Bureau (CFPB) serves as a regulatory body overseeing lending practices across the United States. The CFPB provides resources and information to assist consumers in understanding their rights and reporting any predatory practices they encounter. If you believe you have experienced predatory lending, the CFPB allows you to file a complaint, contributing to broader efforts aimed at holding unethical lenders accountable.

By understanding these federal protections, you can navigate the lending landscape with greater confidence, ensuring that your rights as a borrower are upheld.

State-Specific Regulations: Understanding Local Laws

In Mississippi, specific laws regulate the payday lending industry, offering additional protections to borrowers. These laws include limits on fees and interest rates, ensuring that lenders cannot impose exorbitant charges that would entrap borrowers in a cycle of debt. For instance, Mississippi law caps payday loan fees at a maximum of $20 per $100 borrowed, which can help alleviate the financial burden on borrowers.

It is crucial to familiarize yourself with these state-specific regulations to ensure you are not subjected to unlawful lending practices. Understanding your rights under Mississippi law can provide leverage when negotiating with lenders or filing complaints. Additionally, being aware of local consumer protection agencies can assist you in accessing resources and support if you encounter predatory lending practices.

By educating yourself on state-specific regulations, you can make more informed borrowing decisions and pursue recourse if you believe your rights have been violated.

Filing a Complaint: Taking Action Against Predatory Lending

If you find yourself a victim of predatory lending practices, knowing how to file a complaint is imperative. Both state and federal agencies provide mechanisms for reporting unfair lending practices. The Consumer Financial Protection Bureau (CFPB) is an invaluable resource, allowing you to submit a complaint online regarding any issues you’ve encountered with lenders.

In Mississippi, the Attorney General’s Office also serves as a resource for reporting predatory lending practices. Filing a complaint can help hold lenders accountable while also contributing to broader efforts aimed at strengthening consumer protections in your state. When filing a complaint, be prepared to provide specific details about your experience, including the lender’s name, loan terms, and any correspondence you had with them.

By taking action and filing a complaint, you not only advocate for your rights but also help protect others from falling victim to predatory lending. This proactive approach is essential in fostering a fair lending environment in Mississippi and beyond.

Developing a Comprehensive Financial Plan for Stability

Creating a solid financial plan is one of the most effective strategies to avoid the need for high-cost loans, such as payday loans. By establishing a detailed budget, building an emergency fund, and seeking professional financial counseling, you can position yourself for long-term financial stability and resilience.

Establishing a Practical Budget

A well-crafted budget is foundational for managing your finances effectively. It allows you to monitor your income and expenses while identifying areas where you can cut costs or save more. By comprehending your financial landscape, you can make informed decisions about your spending patterns and avoid situations that may lead to financial distress.

Begin by listing your monthly income sources and fixed expenses, such as rent, utilities, and groceries. Next, categorize your discretionary spending to uncover areas where you can reduce costs. Setting a budget not only aids you in managing your daily finances but also prepares you for unforeseen expenses, thereby minimizing the likelihood of resorting to predatory payday lenders during times of crisis.

In Mississippi, where financial challenges can be prevalent, a well-structured budget can empower you to navigate difficult situations with confidence. By prioritizing your financial health, you can avoid depending on high-cost loans, ensuring greater long-term stability.

Building a Robust Emergency Fund

An emergency fund is a critical component of a sound financial plan. By consistently saving a portion of your income, you can create a financial cushion for unexpected expenses, such as medical emergencies, car repairs, or job loss. Establishing an emergency fund helps lessen reliance on payday loans, providing peace of mind during times of crisis.

Aim to save at least three to six months’ worth of living expenses in your emergency fund. While this goal may appear daunting, small, regular contributions can yield significant results over time. Consider setting up a dedicated savings account to keep your emergency funds separate from your everyday spending.

In Mississippi, where financial instability can be a reality for many, having an emergency fund can serve as a lifeline. It enables you to address unexpected costs without resorting to predatory lending, promoting long-term financial security.

Seeking Professional Financial Counseling

Professional financial counseling can provide invaluable guidance as you navigate your financial landscape. Financial advisors can assist you in assessing your current situation, developing a budget, and creating a personalized financial plan tailored to your specific needs. They can also offer insights on managing debt, improving credit scores, and making informed borrowing decisions.

Many nonprofit organizations offer financial counseling services at little or no cost, making them accessible to individuals in Mississippi. These counselors can empower you with the knowledge and tools necessary to avoid predatory lending practices, ultimately leading to enhanced financial stability.

Seeking financial counseling is a proactive step toward improving your financial health. By investing in your financial education, you can make more informed decisions and dodge the traps set by payday lenders, paving the way for a more secure future.

Negotiating Effectively with Lenders for Better Terms

Negotiating with lenders can greatly enhance your borrowing experience, especially if you find yourself in a challenging financial situation. Understanding the terms of your loan, requesting lower fees or rates, exploring modification options, and obtaining professional assistance can lead to better outcomes and help you steer clear of predatory lending practices.

Understanding Loan Terms Thoroughly

Before entering into any loan agreement, it is essential to thoroughly understand the loan terms. This comprehension empowers you to negotiate better conditions or seek alternatives if the terms are unfavorable. Take the time to read and digest the loan agreement, paying close attention to interest rates, fees, and repayment schedules.

If certain terms seem unclear or excessive, do not hesitate to ask questions. A reputable lender should be willing to elucidate the intricacies of the loan and address any concerns you may have. By fully understanding the loan terms, you can navigate the lending process more effectively and advocate for your financial interests.

Additionally, exploring the total borrowing costs—including interest rates and fees—compared to other lenders can provide invaluable leverage during negotiations. Being knowledgeable about competitive market rates enables you to advocate for fairer terms, thereby minimizing the risk of succumbing to predatory lenders.

Requesting Lower Fees or Interest Rates

Negotiating lower fees or interest rates with lenders can lead to substantial savings over the duration of your loan. Many borrowers may not realize that lenders are often open to negotiation, especially if you have a solid payment history or are a loyal customer. If you feel that the fees or rates are excessively high, do not hesitate to raise this concern during discussions.

When negotiating, maintain a respectful demeanor and clearly articulate your needs. Explain why you believe a lower rate is justified, citing your payment history or current market rates. A straightforward and honest approach can often yield positive results, potentially resulting in a reduction in fees or interest rates.

Furthermore, if you possess a strong credit score, leverage it to negotiate better terms. Lenders are frequently more willing to accommodate borrowers with good credit, so emphasize your financial responsibility during negotiations.

Exploring Options for Loan Modification

Loan modification is another avenue worth exploring if you find yourself struggling to meet your repayment obligations. Modifying your loan terms can make repayment more manageable, providing you with the flexibility needed to avoid default. This process may involve extending the loan term, reducing interest rates, or altering the repayment schedule.

Not all lenders offer loan modification options, so it’s crucial to inquire about this possibility upfront. If your financial situation has changed—such as experiencing job loss or unforeseen medical expenses—communicate this to your lender. Many lenders prefer to collaborate with borrowers to find solutions rather than risk default, particularly if you have been a reliable customer.

Pursuing a loan modification can help you avert the pitfalls of predatory lending, providing you with a more feasible pathway to financial stability and effective debt management.

Enlisting Professional Help for Negotiation

If negotiation feels overwhelming, consider seeking assistance from a professional. Financial consultants or attorneys specializing in consumer protection can offer expert guidance during negotiations with lenders. They understand the intricacies of loan agreements and can advocate on your behalf to secure better terms.

Hiring a professional negotiator can provide peace of mind, as they will handle all communications and negotiations with the lender. This expertise can lead to more favorable outcomes, potentially resulting in lower fees or improved loan terms.

Investing in professional negotiation assistance can be particularly beneficial if you are already in a precarious financial situation. Their knowledge and experience can help you navigate the complexities of lending, ensuring you make informed decisions while minimizing the risk of falling victim to predatory lending practices.

Empowering Yourself and Others Through Financial Education

Education is a powerful weapon in the fight against predatory lending practices. By enhancing your financial literacy and sharing knowledge with others, you can empower both yourself and your community to make informed borrowing decisions and protect against exploitation.

Enhancing Your Financial Literacy Skills

Improving your financial literacy equips you with the skills and knowledge necessary to navigate the lending landscape with confidence. Understanding key financial concepts, such as interest rates, loan terms, and budgeting, enables you to make informed decisions that align with your financial objectives.

Consider taking advantage of educational resources, such as community workshops, online courses, or financial literacy programs offered by local organizations. These resources often cover critical topics, including responsible borrowing, managing debt, and recognizing predatory lending practices.

By investing in your financial education, you can significantly reduce the likelihood of falling victim to predatory lenders. The more informed you are, the better equipped you will be to advocate for your financial well-being.

Sharing Your Knowledge on Financial Education with Others

Sharing your financial knowledge with friends and family can create a ripple effect, empowering others to make informed decisions and protect themselves from predatory lending practices. Engage in conversations about responsible borrowing, saving strategies, and the dangers associated with payday loans. Establishing an open dialogue around financial literacy can help others recognize the signs of predatory lending.

Consider hosting workshops or discussion groups focused on financial education. These forums can provide valuable information while fostering a sense of community. By sharing your insights and encouraging others to prioritize their financial health, you contribute to a more informed and resilient community.

In Mississippi, where predatory lending practices can have significant consequences, fostering financial literacy is crucial. By taking the initiative to educate yourself and others, you can help create a culture of informed borrowers who are better equipped to navigate the lending landscape.

Frequently Asked Questions Regarding Predatory Lending

What defines predatory payday lenders?

Predatory payday lenders engage in unfair practices, often targeting vulnerable borrowers with exorbitant fees, misleading terms, and aggressive sales tactics.

How can I recognize predatory lending practices?

Look for warning signs such as excessive fees, hidden charges, aggressive sales tactics, and loan terms that appear too good to be true.

What alternatives exist to payday loans?

Consider options like credit union loans, personal loans from banks, or borrowing from friends and family to avoid high-cost payday loans.

What legal protections are available against predatory lending?

Federal laws such as the Truth in Lending Act and state-specific regulations provide protections against predatory lending practices, including mandatory loan disclosure requirements.

How can I thoroughly research lenders before borrowing?

Conduct due diligence by verifying lender credentials, reading customer reviews and testimonials, and checking licensing through state authorities.

What steps should I take if I fall victim to predatory lending?

File a complaint with both state and federal agencies, such as the Consumer Financial Protection Bureau and the Mississippi Attorney General’s Office.

How do I effectively create a budget?

List your income and fixed expenses, then categorize discretionary spending to discover areas for cost-cutting. Regularly review your budget to ensure it aligns with your financial goals.

What exactly is an emergency fund, and why is it essential?

An emergency fund consists of savings set aside for unforeseen expenses. It can help prevent the need to resort to predatory loans when unexpected financial emergencies arise.

How can I negotiate with lenders effectively?

Understand your loan terms, request lower fees or rates, and explore modification options. Being informed empowers you during negotiations.

How can I enhance my financial literacy?

Engage with community resources, online courses, or workshops focused on financial education to improve your understanding of borrowing and debt management.

See also: Meridian, MS.

A Mississippi-based financial consultant with over a decade of experience in personal finance and payday lending. Originally from Jackson, he holds certifications in financial planning and credit advisory. Passionate about helping everyday Americans make smarter borrowing decisions, he focuses on guiding people away from common debt traps while promoting healthy financial habits. His expertise bridges the gap between short-term loan needs and long-term money management strategies. Outside of work, he volunteers with local programs that promote financial literacy across Mississippi.

Your discussion on predatory lending practices is crucial, especially in the context of a state like Mississippi, where many individuals struggle with financial stability. It strikes me how often these lending tactics mirror broader societal issues, such as the lack of financial literacy and access to education for vulnerable populations. For instance, when people are unprepared to manage complex financial products, they are more likely to fall victim to these predatory practices.

It’s really important to dig into this connection between predatory lending and financial literacy, especially in a state like Mississippi. You highlighted a key point—when people aren’t equipped to navigate complex financial products, they often find themselves in tough spots. It’s frustrating to see how these lending practices prey on that vulnerability.

I completely agree with you about the connection between predatory lending and financial literacy in Mississippi. It’s a concerning reality that many people find themselves in tricky situations simply because they don’t have the tools to make informed decisions.

You raise an important point about the connection between predatory lending and financial literacy. In a place like Mississippi, where many face economic challenges, the gap in understanding complex financial products can leave individuals vulnerable. It’s frustrating to see how a lack of access to education creates a cycle that makes it easier for these lending practices to thrive.

Ah, the labyrinth of predatory lending—it’s like a financial funhouse where the mirrors are cracked, and the clowns are just a tad too enthusiastic about getting you to sign on the dotted line! Your exploration of this topic truly resonates. It’s like you’re waving a flag in a field of landmines, and believe me, I wish more people would pay attention.

Your exploration of predatory lending practices sheds light on a crucial issue that is often overlooked in discussions about financial literacy and consumer rights. In my experience working with individuals in precarious financial situations, I have witnessed firsthand the devastating effects these loans can have. For many, taking on a payday loan might seem like a quick fix to an urgent problem, but the long-term consequences can be dire, often leading to spiraling debt that becomes increasingly difficult to escape.

I really appreciate you bringing up the topic of predatory lending. It’s such a critical issue, especially in areas like Mississippi where many people are struggling financially. I remember a friend of mine got caught up in a payday loan cycle years ago—she thought she was just borrowing a small amount to cover a bill, but before she knew it, the fees had ballooned, and she found herself with a debt that felt impossible to escape.