Understanding the Impact of Economic Indicators on Payday Loan Trends

Economic downturns profoundly influence consumer behavior, particularly regarding financial products like payday loans. During challenging economic times, numerous economic indicators significantly affect the demand for these immediate financial solutions. Gaining an understanding of these economic indicators is essential for both consumers seeking help and providers of payday loans aiming to meet the needs of their clientele.

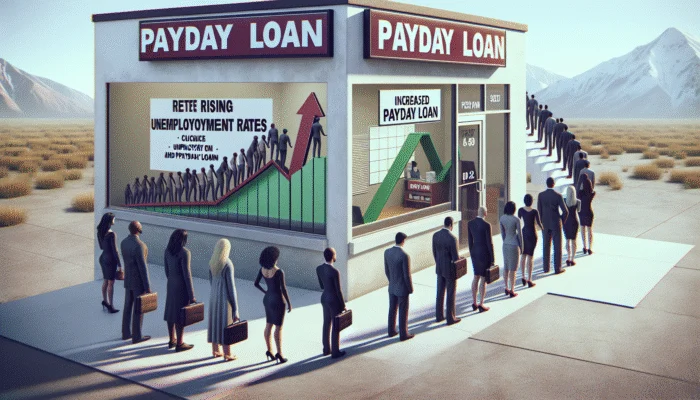

Exploring the Connection Between Unemployment Rates and Payday Loan Demand

The correlation between rising unemployment rates and the heightened demand for payday loans is undeniable. When people experience job loss or reduced working hours, their disposable income shrinks, prompting many to seek immediate financial relief. In the United States, the unemployment rate serves as a critical gauge of economic health. For example, during the COVID-19 pandemic, unemployment rates soared to over 14%, forcing many individuals to turn to payday loans to manage essential expenses such as rent, utilities, and groceries.

The urgency associated with financial needs often drives individuals toward payday loans, which offer quick access to cash—typically within a day. Although these loans are frequently seen as a last resort due to their high-interest rates and associated fees, the immediate cash availability can be far more appealing than the lengthy approval processes of traditional loans. Additionally, the psychological impact of job loss can push individuals further toward these short-term loans, as they prioritize immediate financial stability over long-term financial health.

The relationship between unemployment and payday loan demand highlights a critical issue: as job losses accumulate, so does the financial strain on households, exacerbating the cycle of debt for many. This pattern underscores the urgent need for comprehensive financial education and alternative solutions to lessen reliance on payday loans.

The Role of Consumer Confidence in Payday Loan Demand

Consumer confidence is another crucial economic indicator that impacts the demand for payday loans. When consumer confidence is low, individuals are less inclined to spend on non-essential items and are more likely to save cash. This behavior becomes particularly pronounced during economic downturns, when uncertainty surrounding job security and future income becomes prevalent.

During periods of diminished confidence, households often postpone major purchases, choosing instead to allocate funds toward immediate financial obligations. This mindset drives many individuals to seek payday loans as a means of managing unforeseen expenses or emergencies. For instance, during the Great Recession, consumer confidence plummeted, leading numerous individuals to perceive payday loans as critical tools for financial survival.

Moreover, low consumer confidence typically results in reduced overall spending, which can intensify the recessionary cycle. As businesses witness declining sales, they may resort to layoffs, further increasing unemployment rates and diminishing consumer confidence. This vicious cycle reinforces the demand for payday loans, as individuals grapple with navigating a challenging economic landscape.

By understanding the dynamics of consumer confidence, payday loan providers can tailor their services and marketing strategies to better support their clients. By cultivating an empathetic approach and addressing the concerns of potential borrowers, lenders can foster a more responsible lending environment that ultimately benefits both parties.

Interest Rates: A Key Factor in Payday Loan Accessibility

Interest rates play a vital role in determining the accessibility of financial products, including payday loans. During economic downturns, central banks may lower interest rates to stimulate spending and investment. However, many consumers turning to payday loans do so because traditional lending options become scarce or overly expensive.

When interest rates rise, as they have in recent years, borrowing from traditional lenders becomes more costly, making payday loans seem like a more attractive alternative for those in need. This trend is particularly evident among individuals with lower credit scores, who may find it increasingly difficult to qualify for traditional loans or may face prohibitive rates.

Additionally, as banks tighten lending standards during economic downturns, the gap between accessible credit and rising financial needs widens. Individuals may find themselves in situations where payday loans become their only realistic option. These loans, while expensive, offer immediate relief in times of financial distress, albeit with the risk of falling into a cycle of debt due to high fees and interest.

Understanding the relationship between interest rates and payday loan demand is crucial for both consumers and policymakers. By exploring alternatives and ensuring that financial literacy programs are accessible, communities can better prepare individuals to make informed decisions about their financial futures.

Navigating the Regulatory Environment Influencing Payday Loans

The regulatory environment surrounding payday loans significantly affects their demand, particularly during economic downturns. A combination of state regulations and federal oversight creates a complex landscape that shapes how payday loans are marketed and accessed by consumers.

The Impact of State Regulations on Payday Loan Accessibility

In the United States, state regulations governing payday loans vary widely, affecting both the availability and terms of these financial products. Some states impose strict limits on interest rates and fees, while others have few restrictions, allowing payday lenders to operate with greater flexibility. This inconsistency can create a complex patchwork of lending practices that consumers must navigate.

During economic downturns, states with more lenient regulations may see a surge in payday loan demand as individuals seek quick cash solutions without the burden of strict laws. Conversely, states with stringent regulations may experience lower demand, as potential borrowers are deterred by the lack of accessible services or the perceived stigma associated with payday loans.

Furthermore, the regulatory environment can adapt in response to economic conditions. During financial distress, lawmakers may introduce legislation aimed at protecting consumers from predatory lending practices, potentially leading to decreased demand for payday loans. This dynamic underscores the importance of continuous advocacy and public awareness campaigns to ensure that consumers have access to fair lending options.

Understanding state regulations is essential for both consumers and payday lenders. By remaining informed about the legal landscape, individuals can make more educated decisions regarding their borrowing options, and lenders can align their practices with regulatory requirements to build trust and transparency.

The Role of Federal Oversight in Shaping the Payday Loan Market

Federal oversight of the payday loan market plays a crucial role in shaping demand, especially during economic downturns. Agencies such as the Consumer Financial Protection Bureau (CFPB) are tasked with monitoring lending practices and implementing regulations designed to protect consumers from abusive practices.

During periods of economic strife, federal policies can influence payday loan market dynamics. For instance, the CFPB previously introduced regulations aimed at curbing predatory lending practices, such as requiring lenders to assess a borrower’s ability to repay the loan. While these measures were designed to protect consumers, they also impacted overall demand for payday loans by making it more challenging for lenders to operate.

Moreover, federal policies can affect broader economic conditions, thereby influencing the demand for payday loans. For example, stimulus packages aimed at bolstering the economy can alleviate some financial pressures on consumers, potentially reducing reliance on payday loans. Conversely, when federal measures fail to effectively address economic challenges, demand for payday loans may surge as individuals seek immediate relief.

Understanding the interplay between federal oversight and payday loan demand is vital for consumers and policymakers alike. By advocating for fair and transparent lending practices, both parties can work towards creating a more stable financial environment, particularly during economic downturns.

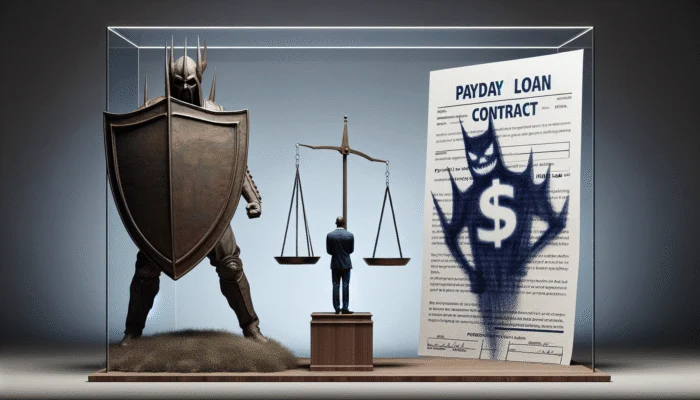

Consumer Protection Laws and Their Effect on Payday Loan Demand

Consumer protection laws are designed to safeguard borrowers from predatory lending practices, significantly impacting the demand for payday loans. As economic downturns heighten financial vulnerability, these laws become even more critical in shaping lending behaviors and consumer choices.

Stronger consumer protection laws can alter the demand for payday loans by establishing clear guidelines for lenders and ensuring that borrowers are treated fairly. For example, laws that cap interest rates and fees can render payday loans less predatory, improving accessibility for those urgently in need of financial assistance.

Conversely, when consumer protection laws are weak or poorly enforced, borrowers may find themselves trapped in cycles of debt, leading to increased demand for payday loans. In such scenarios, individuals often resort to borrowing to pay off existing loans, exacerbating their financial distress and creating a harmful cycle of borrowing.

The effectiveness of consumer protection laws is especially crucial during economic downturns, as vulnerable populations face heightened financial pressures. Advocating for stronger laws and increased transparency in payday lending can empower consumers to make more informed decisions and reduce reliance on high-cost loans.

Ultimately, the relationship between consumer protection laws and payday loan demand highlights the need for a comprehensive approach to consumer finance. By fostering an environment that prioritizes borrower welfare, stakeholders can create a more sustainable lending landscape.

Understanding Demographic Influences on Payday Loan Demand

Economic downturns not only affect the overall demand for payday loans but also reveal significant demographic disparities in borrowing behavior. Various factors, including income levels, age groups, and employment sectors, contribute to these differences, shaping how diverse populations respond to financial strain.

The Relationship Between Income Levels and Payday Loan Usage

Income levels are a critical determinant of payday loan demand, particularly during economic downturns. Lower-income households often experience greater financial instability, making them more vulnerable to economic shocks. Consequently, these households are more likely to resort to payday loans as a means of navigating financial hardships.

Research indicates that individuals living paycheck to paycheck are particularly susceptible to financial emergencies, such as unexpected medical bills or car repairs. During economic distress, these unforeseen expenses can prompt low-income individuals to seek payday loans, often viewing them as necessary tools for survival.

Additionally, low-income borrowers may have limited access to traditional credit options due to poor credit scores or insufficient collateral. As traditional lenders tighten their standards during downturns, payday loans may become one of the few accessible financial products available. This trend underscores the importance of financial education and alternative lending options, which can help mitigate reliance on payday loans.

Understanding the relationship between income levels and payday loan demand is essential for policymakers and community organizations. By addressing the root causes of financial instability and providing resources for low-income households, it may be possible to reduce the demand for payday loans and enhance overall financial well-being.

Age Demographics and Their Influence on Payday Loan Demand

Age demographics significantly shape payday loan demand, especially during economic downturns. Younger adults, particularly those in their twenties and thirties, may be more inclined to use payday loans due to financial instability, lack of credit history, and lower income levels.

Many young adults are navigating new financial responsibilities, such as student loans, rent payments, and living expenses. As they face escalating costs of living, economic downturns can intensify their financial challenges, prompting them to seek quick cash solutions like payday loans. Furthermore, younger individuals may lack the experience or knowledge to explore alternative financial products, often leading them to rely on payday loans out of desperation.

Moreover, societal changes, such as shifts in employment patterns and the rise of the gig economy, have further complicated financial stability for younger generations. The expansion of contract work and part-time positions can lead to unpredictable income, pushing young adults toward payday loans during periods of financial uncertainty.

Recognizing the unique needs of younger borrowers is essential for lenders and policymakers alike. By promoting financial literacy programs tailored to younger audiences, stakeholders can empower individuals to make informed financial choices, thereby reducing reliance on payday loans and fostering long-term financial health.

The Impact of Employment Sectors on Payday Loan Demand

The specific employment sectors affected by economic downturns also influence payday loan demand. Industries such as manufacturing, hospitality, and retail are often hit hardest during economic recessions, resulting in increased unemployment and financial strain for workers in these fields.

Workers in sectors particularly vulnerable to economic fluctuations may find themselves relying more heavily on payday loans as job security dwindles. For example, during the pandemic, employees in hospitality and leisure faced significant layoffs and reduced hours, leading many to seek immediate financial relief through payday loans. This trend illustrates how specific industries can drive demand for payday loans in times of crisis.

Additionally, the nature of employment in certain sectors can further exacerbate financial vulnerability. For instance, gig economy workers or individuals in seasonal jobs may experience inconsistent income, making them more susceptible to financial emergencies. As economic downturns heighten job insecurity, workers in these sectors may increasingly turn to payday loans to manage cash flow issues.

Understanding the relationship between employment sectors and payday loan demand is vital for crafting targeted policies and support systems. By addressing the unique challenges faced by workers in vulnerable industries, stakeholders can help foster economic resilience and reduce reliance on high-cost loans.

Exploring Financial Alternatives to Payday Loans

As the demand for payday loans surges during economic downturns, it’s critical to explore the financial alternatives available to consumers. Many individuals may be unaware of options that can help them avoid the pitfalls of payday loans, which often come with exorbitant interest rates and fees.

The Role of Credit Card Usage in Payday Loan Demand

The utilization of credit cards often fluctuates during economic downturns, significantly impacting the demand for payday loans. When consumers face financial emergencies, they may turn to their credit cards to bridge the gap. However, if credit cards are maxed out or if individuals have poor credit histories, they may find themselves with limited options, leading them to payday loans instead.

For many, maxed-out credit cards signify financial distress, limiting their ability to manage ongoing expenses. When individuals reach their credit limits, they may feel compelled to seek payday loans to cover essential costs, such as rent or medical bills. This dependency can further trap individuals in a cycle of debt as they struggle to pay off both credit card balances and payday loans.

Moreover, high-interest rates on credit cards can render borrowing from traditional sources less appealing during downturns. As consumers weigh their options, the allure of payday loans may grow stronger, despite the inherent risks. By understanding these dynamics, consumers can better navigate their financial choices and consider alternatives to payday loans.

Financial institutions and community organizations should prioritize educating consumers about responsible credit card usage and the potential pitfalls associated with payday loans. Encouraging sound financial practices can help individuals build a more sustainable financial future and reduce reliance on high-cost loans.

Personal Loans as an Alternative to Payday Loans

The availability of personal loans is another critical factor influencing payday loan demand. During economic downturns, many financial institutions tighten their lending criteria, making it increasingly challenging for consumers to secure personal loans. This tightening can push individuals toward payday loans, which are often more accessible despite their high costs.

When traditional lenders impose stricter requirements for personal loans, individuals with less-than-perfect credit or insufficient income may find themselves unable to qualify. Consequently, those who would typically seek personal loans for emergency expenses may resort to payday loans as a quick fix. This situation can create a cycle of debt, as individuals may find it difficult to repay high-interest payday loans, leading to further financial instability.

Additionally, personal loans generally offer lower interest rates than payday loans, making them a more affordable option for qualifying borrowers. However, the barriers to obtaining personal loans during downturns can leave many individuals with no choice but to turn to payday loans, highlighting the urgent need for accessible lending options.

To mitigate the impact of economic downturns on payday loan demand, financial institutions should consider reevaluating their lending practices. By offering more flexible terms and promoting personal loans as viable alternatives, lenders can help consumers navigate financial challenges without resorting to high-cost loans.

The Importance of Savings and Investments in Reducing Payday Loan Reliance

Depleted savings can lead to greater reliance on payday loans during economic downturns. When unexpected expenses arise, individuals who lack sufficient savings may feel compelled to turn to payday loans as an immediate solution to their financial challenges.

Economic downturns often result in job loss or reduced income, making it difficult for consumers to maintain their savings. As savings accounts dwindle, individuals may find themselves without a financial cushion to fall back on during tough times. This lack of savings can create a sense of urgency, pushing individuals toward payday loans to cover essential expenses, including medical bills or car repairs.

The absence of savings not only exacerbates financial vulnerability but also perpetuates cycles of debt. Those who rely on payday loans to meet immediate needs may struggle to repay their loans, leading to further borrowing and a deeper financial crisis. This situation emphasizes the importance of building savings and creating financial plans that can withstand economic fluctuations.

To address this issue, financial education programs should underscore the significance of saving and budgeting. By encouraging individuals to establish emergency funds and develop sound financial practices, communities can help reduce reliance on payday loans and promote long-term financial stability.

Effective Marketing Strategies of Payday Loan Companies

The marketing strategies employed by payday loan companies can significantly influence demand, particularly during economic downturns. As financial pressures mount, these companies often intensify their advertising efforts to attract vulnerable consumers seeking quick cash solutions.

Adjusting Advertising Strategies During Economic Downturns

Payday loan companies frequently modify their marketing strategies in response to prevailing economic conditions. During downturns, these companies may ramp up advertising to capitalize on the increased financial distress experienced by consumers. With more individuals seeking immediate financial relief, payday lenders aim to position themselves as viable solutions to urgent cash needs.

Advertising campaigns during economic downturns often emphasize the speed and ease of obtaining payday loans. By highlighting quick approval processes and minimal requirements, lenders can appeal to consumers who may feel overwhelmed by their financial situations. For many, the promise of fast cash becomes an attractive option, despite the potential risks associated with high-interest loans.

Additionally, payday loan companies may utilize various marketing channels, including online platforms and social media, to reach their target audiences effectively. By leveraging digital advertising and targeted messaging, lenders can connect with consumers actively seeking financial solutions, thereby increasing their market share during challenging economic times.

While increased advertising may benefit payday loan companies, it raises ethical concerns regarding the promotion of high-cost loans during vulnerable moments. Stakeholders must critically evaluate the impact of these marketing strategies on consumer behavior and advocate for responsible lending practices.

Targeting Vulnerable Populations Through Marketing

Payday loan companies frequently direct their marketing efforts toward vulnerable populations disproportionately affected by economic downturns. This targeted approach enables lenders to reach individuals who may be in urgent need of financial assistance, thereby increasing the demand for payday loans.

Vulnerable populations may include low-income households, single parents, and individuals experiencing job insecurity. By tailoring marketing messages to address the specific challenges faced by these groups, payday loan companies create a sense of urgency around their products. For example, advertisements may highlight the ability to cover essential expenses or manage unexpected bills, further enticing individuals to seek payday loans as a solution.

While this targeting strategy can effectively drive business, it raises ethical questions about the potential exploitation of financially vulnerable individuals. Stakeholders must critically assess the impact of payday loan marketing on consumer behavior and advocate for responsible lending practices that prioritize borrower welfare.

To promote healthier financial outcomes, community organizations should work to raise awareness of the risks associated with payday loans and provide education on alternative financial products that may better serve vulnerable populations.

Online vs. Physical Locations: The Shift in Payday Loan Services

The transition to online services has transformed the payday loan landscape, significantly impacting accessibility and demand. During economic downturns, the convenience of online payday loans becomes particularly appealing to consumers seeking quick financial relief.

The proliferation of online payday loan providers has simplified access to these financial products without necessitating visits to physical locations. This shift is especially beneficial for individuals facing mobility challenges or those residing in remote areas with limited access to traditional lenders.

However, the ease of online access can also lead to increased demand for payday loans, as consumers may be drawn to the promise of fast cash at their fingertips. The potential for impulse borrowing may increase, particularly during times of financial stress when individuals are actively seeking immediate solutions to their problems.

It is crucial for consumers to approach online payday loans with caution, as the risk of predatory lending practices may be heightened in the digital space. By staying informed about the terms and conditions associated with online payday loans, individuals can make more educated decisions regarding their borrowing options.

Community organizations and advocacy groups should promote financial literacy initiatives that address the unique challenges posed by online lending. By providing resources and education, stakeholders can help consumers navigate the digital lending landscape responsibly and reduce reliance on high-cost payday loans.

The Influence of Social Media on Payday Loan Marketing

Payday loan companies have increasingly embraced social media platforms as key components of their marketing strategies. These platforms provide powerful avenues for targeted advertising and customer engagement, particularly during economic downturns when demand for quick cash solutions surges.

Social media enables payday loan companies to reach a broad audience, tailoring their messaging to resonate with individuals facing financial challenges. By utilizing targeted ads and engaging content, lenders can effectively communicate the benefits of their products to potential borrowers. For instance, social media campaigns may emphasize the speed and convenience of payday loans, appealing to consumers in urgent need of cash.

However, the use of social media for promoting payday loans raises ethical concerns regarding the potential exploitation of vulnerable individuals. The rapid dissemination of information can lead to impulse borrowing without adequate consideration of the long-term consequences. This pattern underscores the need for increased awareness and education surrounding payday loans and their associated risks.

To combat the potential negative impact of social media marketing, community organizations and policymakers should collaborate to promote responsible lending practices. By advocating for transparency and consumer education, stakeholders can empower individuals to make informed decisions about their financial futures.

The Importance of Regulatory Compliance in Marketing Strategies

Payday loan companies must navigate a complex regulatory environment while crafting their marketing strategies. Compliance with state and federal regulations is essential to ensure that lenders operate ethically and maintain consumer trust, particularly during economic downturns.

As regulations evolve in response to changing economic conditions, payday loan companies must remain vigilant in their marketing practices. This includes ensuring that advertising messages accurately reflect the terms and conditions of payday loans, providing transparent information about fees and interest rates. By fostering a culture of compliance, lenders can build credibility with consumers and mitigate the risk of regulatory penalties.

Moreover, adherence to consumer protection laws can influence marketing strategies. Lenders that prioritize ethical practices may find that their transparency and commitment to responsible lending resonate with consumers, ultimately enhancing their reputation in the marketplace.

To promote a healthier lending environment, stakeholders should advocate for regulatory frameworks that encourage ethical marketing practices while simultaneously protecting consumers. By fostering collaboration between lenders, regulators, and community organizations, it may be possible to create a more sustainable payday loan market.

How Economic Recovery Affects Payday Loan Demand

As economies begin to recover following downturns, the demand for payday loans may undergo significant changes. Understanding these shifting dynamics is crucial for both consumers and lenders navigating a post-recession landscape.

Identifying Post-Downturn Trends in Payday Loan Demand

As the economy stabilizes and job opportunities increase, demand for payday loans may decline. Individuals who previously relied on short-term loans during difficult times may find themselves in improved financial positions, allowing them to avoid high-cost borrowing. This trend is particularly evident during periods of sustained economic growth, when consumer confidence rises, leading to increased spending and investment.

However, the long-term impact of payday loan usage during downturns should not be underestimated. Many individuals who relied on payday loans may find themselves in precarious financial situations even as the economy recovers. The cycle of debt created by repeated borrowing can lead to ongoing financial instability, perpetuating the need for quick cash solutions.

In this context, it is essential for lenders to adopt a proactive approach, offering resources and education to help borrowers transition away from payday loans. By emphasizing responsible lending practices and providing alternatives, payday loan companies can support consumers as they navigate their financial recovery.

Examining the Long-Term Impact of Payday Loans on Borrowers

The long-term impact of payday loans on borrowers is a critical consideration in the aftermath of economic downturns. Repeated use of payday loans can lead to a host of financial challenges, including increased debt, damaged credit scores, and long-term financial insecurity.

Individuals who depend on payday loans may find themselves trapped in a cycle of debt, struggling to repay high-interest loans while attempting to meet ongoing financial obligations. This situation can create a cascading effect, where borrowers resort to additional payday loans to cover existing debt, further compounding their financial difficulties.

Moreover, the psychological toll of financial instability can have lasting effects on individuals and families. Chronic stress related to debt can hinder overall well-being and exacerbate mental health issues, making it difficult for borrowers to regain financial stability even as the economy recovers.

Recognizing the long-term impact of payday loans is essential for policymakers and stakeholders. By advocating for responsible lending practices and providing resources for financial education, communities can work to mitigate the negative effects of payday loans and support individuals in their journey toward financial recovery.

Anticipating Policy Changes Following Economic Recovery

In the wake of economic recovery, policymakers may reevaluate regulations surrounding payday loans to address the issues highlighted during downturns. The crisis may serve as a catalyst for more robust consumer protections aimed at preventing predatory lending practices and ensuring that borrowers have access to fair financial products.

Potential policy changes may include stricter interest rate caps, enhanced transparency requirements, and improved access to alternative financial products. By learning from the challenges experienced during economic downturns, lawmakers can create a more equitable lending landscape that promotes responsible borrowing.

Moreover, community organizations and advocacy groups can play vital roles in shaping these policy changes. By raising awareness of the risks associated with payday loans and advocating for consumer-friendly regulations, stakeholders can help ensure that the needs of vulnerable populations are prioritized in the policy-making process.

Ultimately, the potential for policy changes in the aftermath of economic recovery underscores the importance of ongoing dialogue and collaboration among stakeholders. By working together to create a more sustainable lending environment, communities can foster greater financial stability for all individuals.

Shifts in Consumer Behavior During Economic Recovery

As individuals navigate the economic recovery process, shifts in consumer behavior may influence the demand for payday loans and alternative financial products. Changes in spending habits, savings practices, and attitudes toward borrowing can shape how consumers approach their finances moving forward.

In the wake of economic downturns, consumers may become more cautious about their spending, prioritizing savings and budgeting as they rebuild their financial foundations. This behavioral shift can lead to a decreased reliance on payday loans, as individuals aim to avoid high-cost borrowing and develop healthier financial habits.

Moreover, increased financial literacy and awareness of alternative financial products may empower consumers to explore options that align better with their long-term goals. As individuals gain a deeper understanding of personal finance, they may be more inclined to seek out low-interest personal loans or community resources designed to assist them during challenging times.

Understanding these shifts in consumer behavior is essential for payday loan companies and policymakers. By adapting to the changing landscape and providing resources that align with consumer needs, stakeholders can foster a more responsible lending environment that promotes financial well-being.

Case Studies of Economic Downturns and Their Impact on Payday Loan Usage

Examining past economic downturns offers valuable insights into how payday loan demand fluctuates during times of crisis. Several case studies illustrate borrowing behavior patterns and the unique challenges individuals face during economic strife.

Insights from the Great Recession

The Great Recession, which unfolded from 2007 to 2009, serves as a poignant example of how economic downturns can drive demand for payday loans. As unemployment rates soared and consumer confidence plummeted, many individuals faced unprecedented financial challenges.

During this period, payday lenders experienced a dramatic surge in demand as individuals sought quick cash solutions to cope with mounting expenses. The urgency of financial needs drove many to rely on payday loans for essentials, such as housing and healthcare. The high-interest nature of these loans, however, often led to cycles of debt, exacerbating the challenges faced by borrowers.

As the economy gradually recovered, the lessons learned from the Great Recession prompted discussions about the need for regulatory reforms aimed at protecting consumers from predatory lending practices. This case study highlights the importance of understanding the dynamics between economic downturns and payday loan demand, as well as the potential for policy changes to create a more equitable lending landscape.

Regional Economic Shifts and Their Influence on Payday Loan Demand

Regional economic shifts can contribute to varied payday loan demand across different areas of the United States. Certain regions may experience unique challenges due to industry dependence, local economic policies, or demographic factors, leading to disparities in borrowing behavior.

For instance, areas heavily reliant on industries such as manufacturing or agriculture may face pronounced financial instability during economic downturns. Workers in these sectors may turn to payday loans as job security wanes, resulting in increased demand for short-term financial solutions. Conversely, regions with more diverse economies may exhibit lower demand, as individuals have greater access to alternative financial products.

Understanding these regional differences is essential for lenders and policymakers seeking to address the specific needs of communities. By tailoring approaches to fit the unique circumstances faced by different areas, stakeholders can foster a more supportive lending environment that aligns with local economic conditions.

Industry-Specific Downturns and Their Impact on Payday Loan Demand

Certain industries may experience downturns that drive increased payday loan use among workers within those sectors. Industries such as hospitality and retail are particularly vulnerable to economic fluctuations, with employees facing layoffs and reduced hours during downturns.

For instance, during the COVID-19 pandemic, workers in the hospitality sector experienced significant job losses, prompting many to seek payday loans as a means of financial survival. The immediate need for cash to cover essential expenses often outweighed concerns about the high cost of borrowing, leading to an uptick in payday loan demand.

Examining industry-specific downturns can provide valuable insights into the interplay between economic conditions and payday loan behavior. By understanding how various sectors are affected by economic fluctuations, lenders and policymakers can develop targeted strategies to address the unique challenges faced by workers in vulnerable industries.

Public Perception of Payday Loans and Its Influence on Demand

Public perception of payday loans significantly shapes demand, especially during economic downturns. As consumers grapple with financial challenges, their attitudes toward payday loans can influence borrowing behavior and overall market dynamics.

The Role of Media Coverage in Shaping Public Perception

Media coverage of payday loans often emphasizes the potential risks and pitfalls associated with high-cost borrowing. During economic downturns, the media frequently highlights stories of individuals trapped in cycles of debt due to payday loans, contributing to negative perceptions of these financial products.

While media coverage can serve to raise awareness of the issues surrounding payday loans, it can also create a stigma that deters individuals from seeking assistance when they need it most. The portrayal of payday loans as predatory may lead some consumers to avoid seeking financial help altogether, potentially exacerbating their financial difficulties.

Conversely, positive media coverage of alternative financial products and resources can foster a more informed public perception. By showcasing success stories of individuals who have navigated their financial challenges successfully, the media can help shift the narrative surrounding payday loans and promote healthier borrowing practices.

As public perception of payday loans continues to evolve, it is essential for stakeholders to engage in meaningful conversations about responsible lending practices and the importance of financial education. By fostering transparency and awareness, the financial landscape can become more supportive of consumers seeking assistance during times of crisis.

Frequently Asked Questions About Payday Loans

What are Payday Loans?

Payday loans are short-term, high-interest loans typically offered to individuals in need of quick cash. Borrowers are usually required to repay the loan with their next paycheck.

How Do Economic Downturns Affect Payday Loan Demand?

Economic downturns increase financial stress, leading more individuals to seek payday loans as quick solutions to manage emergencies due to rising unemployment and decreased consumer confidence.

Are Payday Loans Regulated in the United States?

Yes, payday loans are regulated at both state and federal levels. Regulations vary by state, affecting lending practices, interest rates, and borrower protections.

What Are the Risks Associated with Payday Loans?

Payday loans often carry high interest rates and fees, leading to a cycle of debt for borrowers who may struggle to repay the loan on time.

What Alternatives Exist to Payday Loans?

Alternatives include personal loans, credit cards, community assistance programs, and negotiating payment plans with creditors, which can provide more sustainable financial solutions.

Who Is Most Likely to Use Payday Loans?

Individuals with lower incomes, uncertain job situations, and limited access to traditional credit options are more likely to rely on payday loans during economic downturns.

Can Payday Loans Impact Credit Scores?

While payday loans themselves typically do not report to credit bureaus, failure to repay them can lead to collections and negatively affect credit scores.

What Should Consumers Consider Before Taking a Payday Loan?

Consumers should assess their ability to repay the loan, the associated costs, and explore alternative options that may offer better financial outcomes.

Are There Consumer Protection Laws Against Payday Lenders?

Yes, various state and federal consumer protection laws exist to prevent predatory lending practices, including interest rate caps and disclosure requirements.

How Can Consumers Avoid Falling into a Cycle of Payday Loan Debt?

Educating themselves about personal finance, setting up an emergency fund, and exploring alternative financial products can help consumers avoid reliance on payday loans.

See also: Economic Trends.

See also: Pearl, MS.

A Mississippi-based financial consultant with over a decade of experience in personal finance and payday lending. Originally from Jackson, he holds certifications in financial planning and credit advisory. Passionate about helping everyday Americans make smarter borrowing decisions, he focuses on guiding people away from common debt traps while promoting healthy financial habits. His expertise bridges the gap between short-term loan needs and long-term money management strategies. Outside of work, he volunteers with local programs that promote financial literacy across Mississippi.

Your exploration of the relationship between economic indicators and the demand for payday loans highlights a crucial aspect of consumer finance, particularly during turbulent times. The connection between unemployment rates and the need for such financial products is particularly striking.

It’s interesting to see how you’ve picked up on the dynamics between economic indicators and payday loan demand. It’s a real eye-opener when you start digging into how many folks find themselves relying on these loans, especially when jobs become scarce.

Your analysis sheds light on a critical yet often overlooked aspect of consumer finance during economic downturns. The direct link between unemployment rates and the demand for payday loans underscores the urgent need for accessible financial education and resources, particularly in times of crisis.

You’ve brought up such an intriguing and multifaceted topic. The relationship between economic indicators like unemployment rates and the increasing demand for payday loans truly highlights the vulnerabilities many individuals face during economic downturns. It’s fascinating yet disheartening to see how external economic pressures can dictate financial choices for so many.